A Hybrid Approach: Hashflow

Trading, a primitive of all financial arrangements, has historically been enabled by intermediating exchanges. That form factor largely carried over unchanged to today’s cryptocurrency markets – that is until the concept of a decentralized exchange (DEX) was realized. Now, these disruptive market-making models exhibit broad ecosystem adoption and continue attracting significant month-over-month volume growth. It is therefore of no surprise that the pace of innovation in DeFi continues to be led by the segment. As we look forward, appreciating the direction that developers are pushing these avant-garde trading models requires a brief review of the industry’s current state. This context then leads to our perspective on Hashflow, a project innovating on established architectures and one that we think has the potential to enhance the value delivered to users through a more calibrated approach to asset price discovery.

Figure 1: Monthly DEX volume, source: Q2'21 DeFi Review – Messari

The Current State of Crypto Exchanges – CeFi versus DeFi

At present, investors and traders benefit from a plethora of choices when deciding where to execute their digital asset trading operations. While expansive, the crypto exchange industry can be neatly bifurcated into two distinct classes: centralized and decentralized.

A brief aside:

Market makers: in traditional equity markets, designated market makers are hired by exchanges to facilitate liquidity for specific securities by maintaining a book of buy and sell quotes around the market price. Their operations depend on making a spread between the bid and ask and managing their respective inventories. Market making strategies are also deployed by independent trading desks in a similar manner beyond the confines of regulated exchanges – this is similar to how many traders operate today within digital asset marketplaces.

Exchanges: historically, market makers held memberships with exchanges to conduct their operations as described above. Today, exchanges have largely digitized and act as crossing networks for traders and broker-dealers.

Centralized exchanges (CEXes) continue to dominate digital asset spot and derivative trading volumes due to several fundamental factors. First, the embryonic state of the industry attracted the attention of Wall Street trading professionals who lifted their experience from traditional finance and applied it to cryptocurrencies. Noteworthy examples include Fred Ehrsam, a former FX trader and co-founder of Coinbase (est. 2012), Changpeng Zhao or "CZ", a trading systems developer and founder of Binance (est. 2017), and Sam Bankman-Fried, a former Jane Street trader and founder of FTX (est. 2017). Once public interest was piqued, the first-mover advantage, a lack of battle-tested primitive DeFi functions, and a refined user experience meant that centralized operators existed as the primary conduit for the industry's trading volumes – economies of scale and a favorable fee structure soon followed. Consequently, the user-centric industry, built to intentionally circumvent financial intermediaries, had grown increasingly dependent upon their trading and custodial services. Backdropping this against the industry’s persistent memory of Satoshi’s idyllic intent and on-chain, smart contract-based exchange became all but inevitable.

From the start, decentralized exchange was always viewed as an achieve-able goal by blockchain developers, and many projects were created to pursue a myriad of models – for example, atomic swaps, bridges, and relaying. Early implementations struggled to garner traction with users due to complex interfaces and limited feature sets. Eventually, Bancor introduced the Automated Market Maker (AMM) in 2017, scrapping the notion of an order book in favor of on-chain liquidity pools and algorithmic trade routing. The AMM model was a significant improvement over existing options, but trading fees remained too high to incent broad switching. That is until Uniswap simplified the conversion algorithm (i.e., x * y = k, or the constant product formula) and drastically reduced the cost of routing a trade. Uniswap’s iteration saw explosive growth and forks of the project brought a new breed of AMMs that would soon begin collectively attracting market share away from centralized competitors (see Figure 2). Despite the innovation and immense volume Uniswap attracted, the core architecture’s fundamental reliance upon bonding curves and constant-product inventory management often introduced unique challenges for users and liquidity providers, especially when pricing more volatile assets, e.g., options contracts.

Figure 2: DEX volumes as a percentage of CEX volumes, source: Q2'21 DeFi Review – Messari

The Hybrid Opportunity

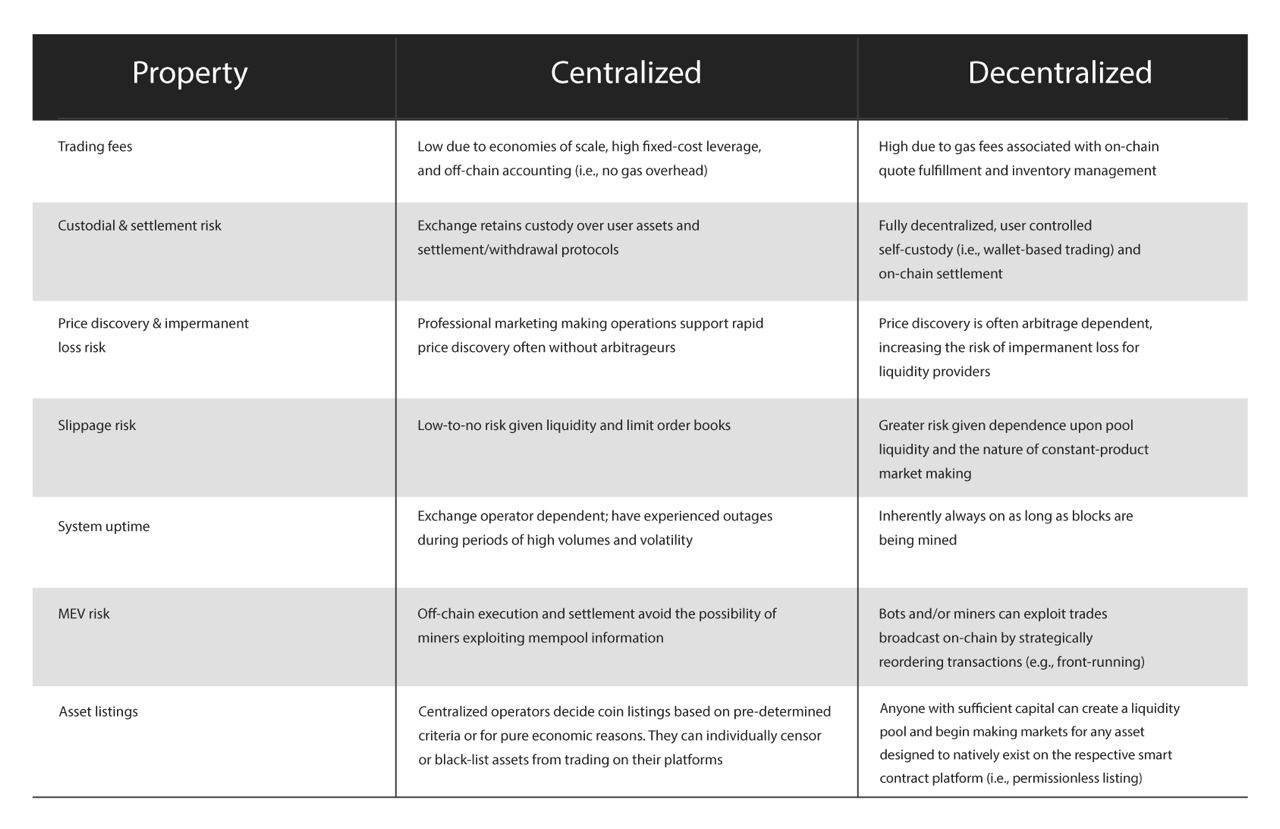

Exchange users face inherent compromises when deciding between trading on a purely centralized versus decentralized basis. We summarize seven below:

The set of tradeoffs naturally begs the question – can the best respective features of CEXes be married with those of DEXes to optimize cryptocurrency trading? In other words, a hybrid approach, where institutional-grade market makers with deep experience in efficiently managing capital are aggregated to provide automated quotes through a permissionless front-end whereby users benefit from lower trading fees and retain the security of on-chain settlement and self-managed custody. Queue Hashflow.

Hashflow Overview

The Hashflow protocol employs a request for quote (RFQ) model popularized by traditional over-the-counter (OTC) trading, served by professional market makers, and merges that with a Web3 "vending machine experience" like front-end. In a recent podcast interview, founder Varun Kumar highlighted the catalyst for his team’s ambition – to decouple decentralized trading’s reliance on an algorithmic pricing regime and shift those decisions to expert humans that could apply their powerful off-chain models to improve pricing. Although the project is only operational in a pre-alpha release today, the architecture’s theoretical at-scale benefits relative to alternatives are supported by economic intuition. We take a deeper look at how Hashflow stacks up against decentralized and centralized peers across the addressed properties below.

Versus DEXes

Hashflow’s market makers, who will be deploying proprietary quantitative trading systems capable of considering alternative data (e.g., volatility and sentiment analysis) to compute prices off-chain and more efficiently manage capital, should logically be capable of serving quotes that carry lower trading fees than Layer 1 on-chain execution as they avoid the cost overhead and volatility of gas. In most cases, we anticipate fees to be competitive with CEXes. Notably, however, we do expect continued innovation from the pure DEX cohort and will be watching closely as AMMs begin launching on Layer 2 scaling solutions, for example, the recent Uniswap alpha launch on Optimism, and how the competitive environment over volume unfolds.

Contrasted with AMM-based price discovery, high-frequency off-chain data can be analyzed and integrated into the quotes of market makers operating on Hashflow, giving them the flexibility to quickly adapt to market conditions based on their preferred inventory management strategy. When scaled to multiple market makers standing ready to serve quotes, competition for trading volume should quickly bring prices in line with the broader market, benefiting users and enabling a more resilient market structure. With respect to more volatile assets that inherently amplify the risk of impermanent loss faced by AMM liquidity providers, Hashflow’s model gives market makers far more granular control over their inventory, which should translate to significantly less capital required to operate versus a standard AMM liquidity pool and wholly sidesteps the need for and impact of arbitrage-driven pool balancing. Hashflow’s hybrid strategy is therefore likely to draw disproportionate volumes for more naturally volatile assets, e.g., options, presenting an opportunity that the market may not yet fully appreciate.

By deploying an RFQ model, Hashflow’s end-users face no slippage risk. Described as “signature-based pricing”, users receive bespoke quotes from Hashflow’s market makers and then have full discretion overfilling a standing offer or otherwise letting it expire, facing no exposure to the intermediate volatility over the decision period. In other words, once a price is accepted, the order gets submitted on-chain as offered. The RFQ model is also inherently MEV-resistant for traders since once a discrete quote is accepted, it is signed and executed on-chain as is. In the long-term, however, if Hashflow becomes a significant player within the marketplace there may be an incentive for market makers to partner with miners as the former may still face MEV risks once transactions are submitted on-chain.

Versus CEXes

Relative to centralized operators, Hashflow’s model retains the benefits of user-controlled custody and on-chain settlement. When a quote is accepted, the market maker will broadcast the signed transaction to the network, and assets are subsequently exchanged between the user’s wallet and the market maker's pool through Hashflow’s smart contracts. Accordingly, the user maintains wallet-level custody in the same manner as a DEX, similarly translating centralized-custodial risk into smart contract risk.

Despite outsourcing market making to professional traders who have full discretion over their market participation, Hashflow was thoughtfully designed to retain the “always-on” uptime characteristic of the blockchain ecosystems they serve. The team integrated trade routing to existing DEXes for cases where inferior quotes are offered by the platform’s own market makers. This backstop feature, therefore, allows Hashflow to retain the power of a fully decentralized exchange during severe market events or situations where censorship may present itself. While perhaps not intended, it also preempts attempts to aggregate Hashflow’s RFQ service. Furthermore, since anyone can theoretically become a market maker on Hashflow, the platform retains the benefit of permissionless asset listing that DEXes uniquely offer to projects and users.

Thesis summary

Hashflow’s ability to combine the deep liquidity of DeFi with the pricing efficiency of the RFQ model is what leads us towards committing to this investment. We believe a DeFi primitive that can onboard and off-ramp large, institutional-grade traders from DeFi native instruments will be crucial to the industry. Hashflow solves this problem. Having market-makers compete with one another ensures that the quoted prices are the best in the market while simultaneously giving the DeFi based experience to traders. Hashflow’s foray to the market is based on spot market trades but we see it evolving to offer more complex instruments such as derivatives in the immediate future.

Risks

Unproven models in any market naturally carry a higher risk than well-established implementations. More importantly, Hashflow is entering a crowded field of exchange offerings as a hybrid model and will be subject to continued user experience and pricing innovations (e.g., scaling solutions) as well as typical competitive strategies (e.g., price-cutting) on both centralized and decentralized fronts. Since the team is aiming to create a permissionless front-end while retaining a back-end of institutional, potentially regulated market makers, there will likely exist some onboarding friction for users in the form of address whitelisting and KYC/AML protocols. There is also the behavioral risk that Hashflow is viewed by traders as “not decentralized enough” which may impact the potential size of their future customer base.

Team

Hashflow was founded by CEO Varun Kumar, a former aerospace engineer and Stanford graduate. The project is representative of Varun’s obsession with making DeFi more capital efficient and improving the overall market structure of crypto. Other key team members include Victor Ionescu, the project’s CTO and a veteran software engineer who brings experience from Airbnb, Facebook and Google, and Marius Buleandra, a former software engineer at Square and Microsoft.

Special thanks to Joel John for his insight and review.

Disclosures:

Please note that LedgerPrime is an investor in Hashflow.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.