Ben Thompson first proposed aggregation Theory in 2015 to explain how the Internet has contributed to the evolution of markets. Ben described it like this some seven years back:

“The value chain for any given consumer market is divided into three parts: suppliers, distributors, and consumers/users. The best way to make outsize profits in any of these markets is to either gain a horizontal monopoly in one of the three parts or to integrate two of the parts such that you have a competitive advantage in delivering a vertical solution. In the pre-Internet era, the latter depended on controlling distribution. The fundamental disruption of the Internet has been to turn this dynamic on its head. First, the Internet has free distribution (of digital goods), neutralizing the advantage that pre-Internet distributors leveraged to integrate with suppliers. Secondly, the Internet has made transaction costs zero, making it viable for a distributor to integrate forward with end users/consumers at scale.”

Image from Ben Thompson’s original piece from 2015

We believe the theory deserves a revisit from the lens of someone working in Web3. We have seen behemoths like Ramp, Stripe, and Spotify being built through the collapse in the price of distribution and collecting payments. But how does it apply to Web3 firms? We propose that in addition to collapsing the cost of collecting payments, blockchains can reduce the price of verification and trust. This enables the creation of multi-billion dollar entities that were historically not possible. The new era of blockchain-based aggregators also helps drive innovation at the protocol layer and enables a new business model: Hyperfinancialization-as-a-Service.

Collapsing The Cost of Trust

Much like the internet collapsed the cost of distribution and collection of payments, publicly verifiable blockchains have collapsed the cost of verification and trust. Practically all of the enormous businesses we see in the context of Web3 are built on this principle. Blockchains make it possible for anyone to query and verify if a digital good being sold is genuinely from the source it claims to be. There is no counterparty risk for digital consumption goods like NFTs that are sold through a blockchain-enabled platform because verifying a smart contract ensures you are getting the exact good you are paying for.

What does this signify for those running aggregators in Web3? It means it costs a fraction of what it does in Web2 to verify and trust vendors when it comes to sales of digital goods. When Netflix or iTunes initially launched, they had to spend months or years negotiating contracts to ensure they could go to market with a large enough inventory of digital goods that would attract users. Even today, Netflix spends some $16 billion on producing content in-house based on their users’ data. As the size of these aggregators scaled, they became the best place for digital consumption goods to be sold. After a decade’s worth of work, owning the distribution gives them that advantage.

Some interactions are not possible in Web2 aggregators because of the inherent friction introduced by siloed databases and data that is not open. For example, you cannot browse for property listings through Zillow, and subsequently, make an offer on it and move on to refinancing the asset all within the same platform. You would have to go to another venue like Figure and run through their various compliance and onboarding procedures that are unique to each platform. It also makes it much harder and more expensive for developers of other applications to easily tap into your aggregation and build new interesting services on top.

On-chain identity, data, and verification standards can solve for this, and enable Web3 aggregators to be much more efficient than their Web2 counterparts. In stark contrast, OpenSea does not spend much worrying about the licenses. They can almost instantaneously verify that a third party’s NFT comes from a legitimate source and track how it moves across its userbase. What about Uniswap? So long as the user accurately adds the token’s address, there is no need for human involvement in verifying if a token being traded on it is legitimate.

Web3 is interesting because it changes the unit economics of verification and trust. Historically, aggregators would acquire intellectual property rights for the most desirable digital consumables. As we will see in a piece soon, in emerging markets like India, holding the streaming rights for Cricket paved the way for television networks to scale. Blockchains have enabled platforms to prove provenance and authority of issuance from anyone on the web at a fraction of the cost. This means the expenses incurred in legal fees and time spent through bureaucracy is now replaced with on-chain verification, identity, and verification. This principle will be at the crux of what makes aggregators in Web3 massively influential. Don’t believe me? Let’s look at some of the aggregators within the ecosystem today and how they use blockchains to their benefit.

Aggregation in DeFi

Zerion is a wallet interface focused on enabling users to track their portfolios. The product currently tracks NFTs, allows swaps, and gives users a look at how all the tokens in their wallets are performing. Interfaces like those offered by Zerion are quickly becoming the “home page” for DeFi. They allow users to interact with a complex host of apps without going outside the interface of a single website. In addition, these interfaces eliminate the high risks of phishing, losing keys, and signing the wrong smart contracts by allowing users to interact with them directly through their interface. They help users access functions like lending through curating protocols and also drive innovation at the protocol layer by offering more choices to customers that offer them competitive pricing and features. It would be safe to suggest that assets worth a few billion dollars are managed through Zerion’s interface.

How much of that risk is with Zerion? None. They don’t custody the assets and they don’t manage the smart contracts. Instead, they are responsible for embedding each of these protocols into the product to create a super-app. According to a recent press release, they interface with some 50,000 assets across 60 protocols. Comparables like DeBank, Frontier and ImTrust have been at the forefront of enabling more retail participants to find their way around the complex Web3 ecosystem.

How? They reduce the trust barrier required to use an app as an end-user assumes that the interface creators have already exercised due diligence. Secondly, they enable new apps to be discovered far more smoothly than through complex web of information platforms like Twitter. Lastly, and most importantly, they combine the ability to club multiple DeFi DApps in a single interface. They have also begun integrating on-ramps and tax software as users’ needs in the industry evolve.

I have taken Zerion as an example here as it is a centralized entity that acts as an interface to plugin with multiple DeFi DApps. However, aggregation in DeFi runs beyond that. Here are some examples :

Orderflow - 1inch and Matcha.xyz allow users to find the best price for assets that need to be traded without going to individual platforms. They do not custody the assets used for trading themselves but seek liquidity from third-party platforms. Matcha has taken this one step further by integrating a request for quote model in the product. They have done about $42 billion in cumulative volume across ±900k orders so far. This feature allows centralized market-makers in the back end to quote prices for large order sizes, thereby bringing the experience closer to what a centralized exchange like Binance can offer.

Yield - The holy grail for DeFi has historically been the ability to provide yield. The large risk lending or decentralized exchange platforms have is potentially getting hacked. But what if you could build interfaces that allow users to deploy capital in pools while not necessarily holding the assets yourself? Rari, Alpaca and Yearn Finance do just that. Rari alone has deployed $922 million through Fuse pools for a sense of scale. Instadapp takes this one step further with its user experience. The product allows users to manage debt positions or deploy assets into yield-bearing pools using a single interface. They manage around $5 billion worth of assets across the likes of Maker, Compound and Aave through their interface.

Aggregation of The Metaverse

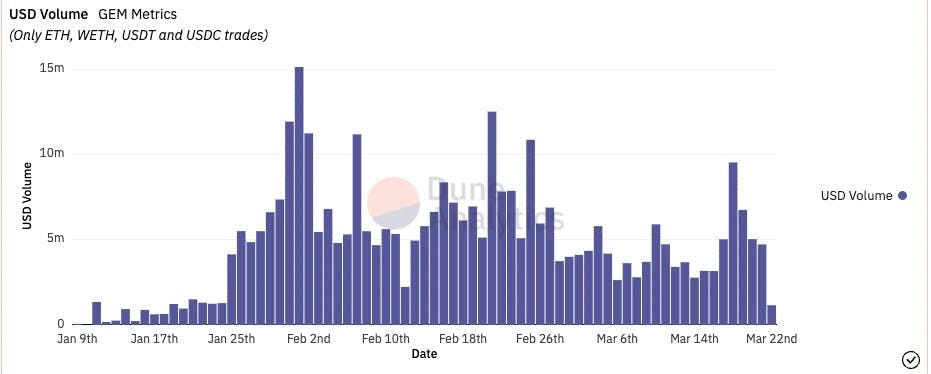

Chart source : Gem Master Dashboard by @bakabhai993

NFTs are interesting from the point of view of aggregation. You have a digital good with transaction finality and on-chain provenance of intellectual property. Please don’t curse me. I will explain it without the jargon. Given that users cannot reverse blockchain transactions, a user buying an NFT almost certainly does not have to worry about losing what they purchased to fraud unless the NFT itself is a duplicate.

They can also verify that it is coming from the right source almost instantaneously. Unlike traditional art markets, you can almost instantly see what the floor price of an NFT is and who its past owners were. These make NFT aggregators incredibly powerful in terms of how they can interact with market participants.

Consider Gem, for instance. The aggregator itself holds none of the NFTs listed on the platform. They use Dune to give analytics to their users. Once you click on a collection, the interface allows you to bid on listings directly in Opensea and LooksRare. Now, this is where this gets even more interesting. Aggregators like Gem become the place for price discovery as users are essentially discovering and tracking their portfolios and bidding through them.

In the future, they’ll also cover features that blur the lines between DeFi and NFTs through lending and automated inventory management. The traditional art or physical market has some of the previously mentioned constraints relevant to Web2 aggregators that prevent them from offering these services at low friction and cost. In addition, some of the other verticals like Gaming and Metaverse do not even have historical analogs - Web3 aggregators will be the first to support and enable efficient markets in those categories of digital assets.

Over time, they can be influential enough to determine which NFT set gets “discovered” as essentially what they are accruing is the market’s attention. How much is that attention worth? I don’t know yet, but it is valuable enough to have driven $400 million in volume through the platform alone. Gem is also influencing the market share of the underlying NFT marketplaces themselves. Because users are marketplace agnostic and will buy and sell assets wherever there is a favorable bid/ask. For example, LooksRare’s market share on NFT volumes went up in relation to OpenSea since gem was launched.

The Next Decade of Aggregation

Let's revisit the core argument of this piece before we wrap up. We believe that blockchains will enable an entirely new category of markets that are able to verify on-chain events instantaneously. This will collapse the cost of validating intellectual property at a massive scale and thereby create new business models. Present-day Web3 aggregators provide interfaces that show on-chain data and allow users to interact with smart contracts from multiple platforms. They don't own the risk of custodying these assets and typically do not bear exponentially higher costs for supporting additional networks. Covalent and Nansen are able to generate exponential value by adding each new chain - which is usually a linear expense.

The core proposition of Web3 aggregation over the next decade will be in streamlining large, messy processes with multiple counterparties in systems with low trust. One instance of this occurring has been AngelList. The platform has structurally collapsed the amount of friction involved in putting together a venture round by combining legal, banking, and LP management in a single interface. How much is that worth? Around $4 billion as per their latest round. Large, messy markets with multiple moving parts are hard to aggregate at scale unless you have time or capital. AngelList took roughly 8 years to build its monopoly, while Uber had to raise some $25.5 billion to become today's behemoth. I believe blockchains will collapse the unit economics around this and hyper-financialise the process. Clubbing the eradication of inefficiencies in what have historically been long, chaotic processes with incentives that allow people to profit from them can be a powerful mix.

We are uniquely positioned at LedgerPrime to detect aggregation early on. As a market-maker, we often see new aggregation categories emerge. We were early to deploy money in option vaults, staking ventures, and more recently in the rapid financialization of the NFT ecosystem. As capital allocators, there is a delicate balance between enabling a new ecosystem and empowering ventures that aggregate a sector. Part of the reason why we have been able to strike that balance right is our involvement from being early investors and our ability to see an organization through to its late stages where a venture becomes dominant enough to become the aggregator. In a follow-on piece, we will be exploring the growth stages of some of our portfolio companies and how the theory has been applicable to them. Stay tuned.

Note: This article was written with inputs from Krishna Sriram, Head of Business Development at Quantstamp.