Market Commentary - BOW 36

General Market Update

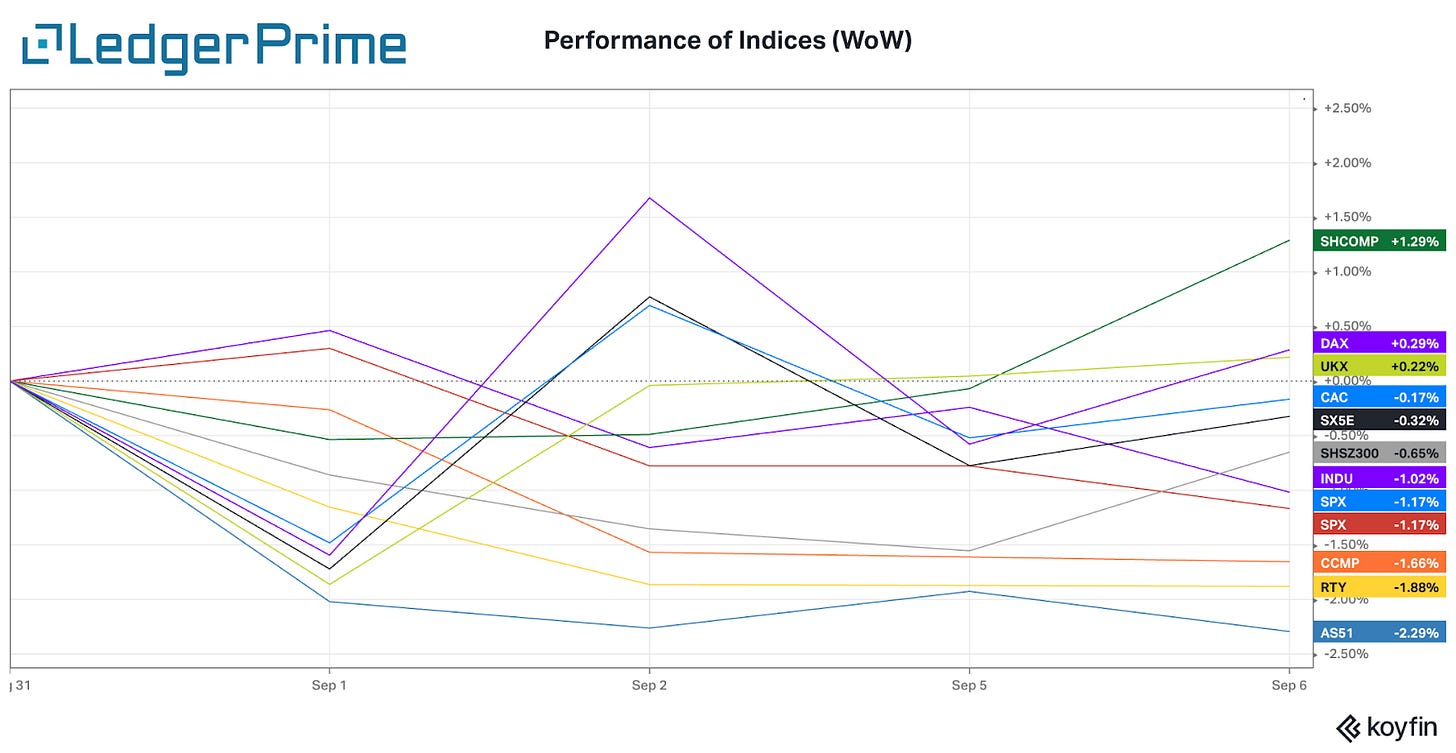

U.S. stock indexes opened higher, suggesting major indexes could rise after three weeks of losses driven by expectations for tighter Federal Reserve policy and an energy crisis in Europe.

The moves in the U.S. accompanied similar gains in European markets, which rebounded after falling Monday following Russia’s indefinite halt of natural-gas flows through a major pipeline.

Much of the recent anxiety in the U.S. has been driven by expectations that the Fed will barrel ahead with tighter monetary policy for much longer than once thought. Many investors are now expecting the Fed to lift interest rates by 0.75 percentage point for a third consecutive time at its meeting later this month.

Wall Street Journal, Sep. 6, 2022 9:44 pm ET

Crypto Market Update

Global Crypto Market Cap 📉 0.11% ($1.04 Tr)

Altcoin share of Market 📉 1.76% (62.34 %)

Crypto Fear and Greed Index: 22 (Fear)

Crypto News & Articles

Circle CEO says Binance decision to stop USDC support is good as it increases utility. Wintermute CEO Evgeny Gaevoy says Tether risks losing ground if it does not improve operational efficiency. – Link

The Bellatrix hard fork has just been activate on the Beacon chain and now only the Paris event remains before Ethereum's switch to proof-of-stake. – Link

Charles Hoskinson calls Ethereum Classic ‘dead project with no purpose’. Hoskinson has recommended Ergo to proof-of-work proponents saying the coin is "innovating and has a great community." – Link

BTC (-1.88%)

Price:

Current price at $19.8K, selling resistance is found at $20K mark while major support appears at $19.7K.Over the week, price ranged from a high of $20.392 to a low of $19,621.

Metrics:

BTC spot volume is currently at $5.56B.

Current Market Cap of BTC is at $385B, which represents a 38.106% of Total Crypto Market Cap.

BTC volatility: The current, annualized volatility is at 0.50, 0.78% higher than last week.

From last week:

📈 Correlations:

7-Day Correlation: ETH (0.88)

30-Day Correlation: ETH (0.91)

📈 Betas:

7-Day Beta: ETH (0.66)

30-Day Beta: ETH (0.57)

News:

Crypto miner Poolin pauses BTC and ETH withdrawals, citing 'liquidity problems' – Link

Options:

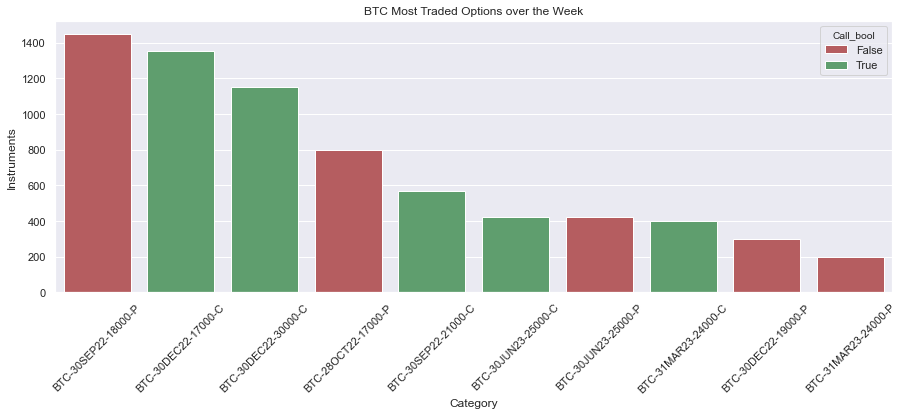

BTC’s option profile was evenly distributed this week, with short/mid-term maturities trading the most. The most traded instrument this week was the BTC-30SEP22-18000-P(1.5K)

Strategies:

Investors continue trading bearish strategies such as the Bear Put Spread (2.8K), which benefit from future market downturns, but some consider prices are low enough and as a consequence, strategies such as the Bull Call Spread are gaining momentum.

IV profile:

1 Wk ATM 68.3% (avg: 67.9%)

1 Mth ATM 70.3% (avg: 70.3%)

25d Skew:

1 Wk 11% (avg: 9%)

1 Mth 15% (avg: 11%)

ETH (+3.64%)

Price:

Current price at $1.66K, current selling resistance is found at $1.7K while bullish support takes place at the $1.55K mark. Over the week the price ranged between a weekly high of $1,670 and a low of $1,483.

Metrics:

ETH spot volume is currently at $1.27B

Current Market Cap of ETH is at $193B, which represents a 19.109% of Total Crypto Market Cap

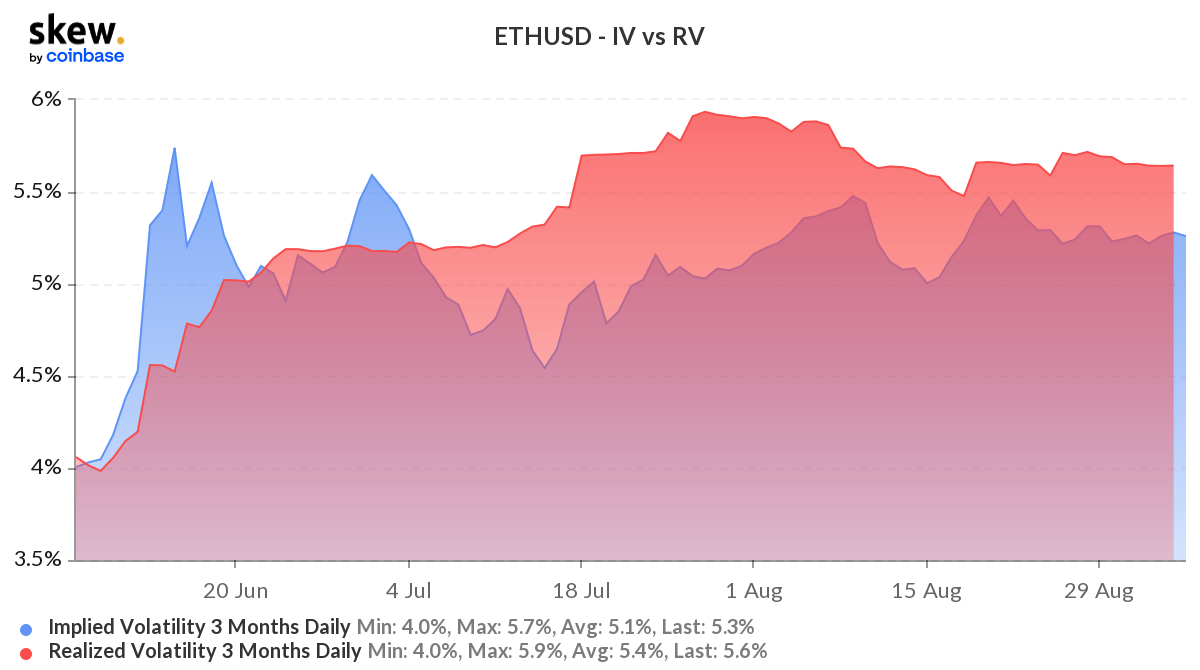

ETH volatility: The current, annualized volatility is at 0.83, 3.45% lower than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.88)

30-Day Correlation: BTC (0.91)

📈 Betas:

7-Day Beta: BTC (1.00)

30-Day Beta: BTC (1.53)

News:

FTX to halt ETH deposit and withdrawals on Arbitrum, Solana, BSC during the Merge – Link

Options:

ETH’s option profile was reclaimed by the buy side, with options such as the ETH-30DEC22-2500-C (36K) trading the most, followed by ETH-30DEC22-1800-C (15K)

Strategies:

The Bull Call Spread, continued to be the most traded strategy this week at 37K in volume, followed by the Bear Diagonal Spread (Puts).

IV profile:

1 Wk ATM 100% (avg: 92%)

1 Mth ATM 100% (avg: 101%)

25d Skew:

1 Wk 9% (avg: 6%)

1 Mth 11% (avg: 7%)

AVAX (+2.60%)

Price:

Current price at $19.97, selling resistance takes place above the $20.5 range while the closest price support seems to be at $20.00. Over the week the price ranged between a weekly high of $20.28 and a low of $18.43.

Metrics:

AVAX spot volume is currently at $4.90M

Current Market Cap of AVAX is at $5.64B, which represents a 0.558% of Total Crypto Market Cap

AVAX volatility: The current, annualized volatility is at 0.75, 4.71% lower than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.82), ETH (0.87)

30-Day Correlation: BTC (0.78), ETH (0.79)

📈 Betas:

7-Day Beta: BTC (0.07), ETH (0.05)

30-Day Beta: BTC (1.04), ETH (0.68)

News:

A sharp drop in TVL and DApp use preceded Avalanche’s (AVAX) 16% correction – Link

SOL (+5.23%)

Price:

Current price at $32.95, selling resistance seems to occur at $33.50 while price support seems to be found at $32.50. Over the week the price ranged between a weekly high of $33.23 and a low of $30.58.

Metrics:

SOL spot volume is currently at $82.71M

Current Market Cap of SOL is at $11.25B, which represents a 1.093% of Total Crypto Market Cap

SOL volatility: The current, annualized volatility is at 0.73, 3.03% lower than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.88), ETH (0.86)

30-Day Correlation: BTC (0.89), ETH (0.87)

📈 Betas:

7-Day Beta: BTC (1.19), ETH (0.79)

30-Day Beta: BTC (1.26), ETH (0.80)

News:

Network outages have been Solana’s ‘curse,’ says co-founder– Link

NEAR (+4.23%)

Price:

Current price at $4.43, selling resistance is found at $4.50 while price support seems to drive buying action at $4.30. Over the week the price ranged between a weekly high of $4.48 and a low of $3.99.

Metrics:

NEAR spot volume is currently at $46.95M

Current Market Cap of NEAR is at $3.39B, which represents a 0.325% of Total Crypto Market Cap

NEAR volatility: The current, annualized volatility is at 0.93, 14.93% lower than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.74), ETH (0.75)

30-Day Correlation: BTC (0.72), ETH (0.76)

📈 Betas:

7-Day Beta: BTC (0.30), ETH (0.06)

30-Day Beta: BTC (1.43), ETH (0.92)

News:

NEAR Top News #3 – Link

ADA (+8.03%)

Price:

Current price at $0.496, selling resistance at $0.51 while price support seems to be at the $0.48 level. Over the week the price ranged between a weekly high of $0.51 and a low of $0.441.

Metrics:

ADA spot volume is currently at $236.214M

Current Market Cap of ADA is at $17.21B, which represents a 1.648% of Total Crypto Market Cap

ADA volatility: The current, annualized volatility is at 0.75, 6.23% higher than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.56), ETH (0.59)

30-Day Correlation: BTC (0.73), ETH (0.72)

📈 Betas:

7-Day Beta: BTC (0.39), ETH (-0.27)

30-Day Beta: BTC (1.20), ETH (0.70)

News:

A range-break from Bitcoin could trigger buying in ADA, ATOM, FIL and EOS this week – Link

MPL (+1.35%)

Price:

Current price at $18.91, upwards selling resistance seems to be found at $19.50, while bullish action takes place at $18.50. Over the week the price ranged between a weekly high of $19.70 and a low of $17.74.

Metrics:

MPL spot volume is currently at $157.29K

Current Market Cap of MPL is at $120M, which represents a 0.012% of Total Crypto Market Cap

MPL volatility: The current, annualized volatility is at 1.04, 0.35% higher than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.17), ETH (0.11)

30-Day Correlation: BTC (0.18), ETH (0.16)

📈 Betas:

7-Day Beta: BTC (-0.73), ETH (-0.74)

30-Day Beta: BTC (0.82), ETH (0.56)

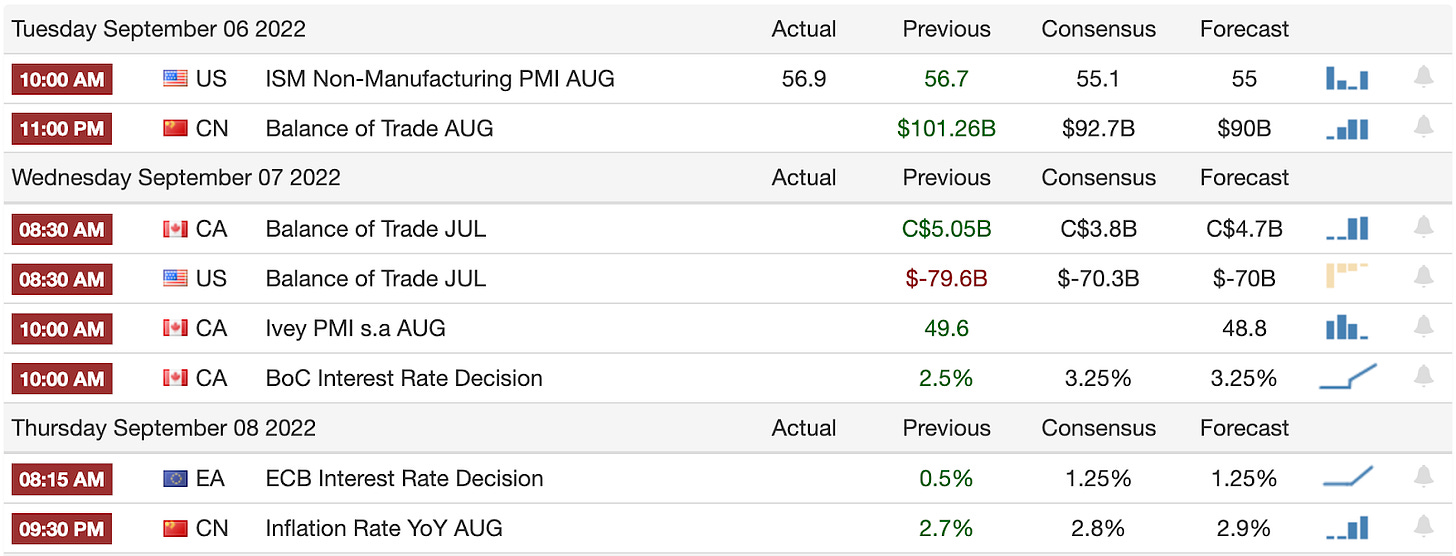

Upcoming events

For OTC inquiries, contact laura@ledgerprime.com

Telegram @lauravidiella or @medianbrain

For live Altcoin and Options data, join our Ledger Prime Analytics group chat here

The information provided here is not investment, tax, or financial advice and does not reflect LedgerPrime’s official stance on any position. You should consult with a licensed professional for advice concerning your specific situation.