Market Commentary - BOW 37

General Market Update

The market didn't like what it saw in Tuesday's CPI report. U.S. stocks fell and Treasury yields rose after the data came in higher than expected.

The pace of U.S. consumer price inflation remained close to a four-decade high, up 8.3% in August from the same month a year ago, the Labor Department said Tuesday.

Still, that headline number cooled compared with previous months. The increase was 8.5% in July and 9.1% in June, which was the highest inflation rate in four decades. The CPI measures what consumers pay for goods and services.

Wall Street Journal, Sep 13, 2022, at 11:00 am ET

Crypto Market Update

Global Crypto Market Cap 📈 2.92% ($1.11 Tr)

Altcoin share of Market 📉 5.83% (61.53 %)

Crypto Fear and Greed Index: 34 (Fear)

Crypto News & Articles

Chamber of Digital Commerce urges SEC to approve Bitcoin ETF for US investors. The Chamber of Digital Commerce said that the SEC's failure to approve a spot bitcoin ETF is forcing U.S. investors to turn to more regulated regions. – Link

Fireblocks records over $100M in annual recurring revenue, solidifies unicorn status – Link

Centralization, sell-offs, and network stability: What’s troubling Ethereum ahead of the Merge? – Link

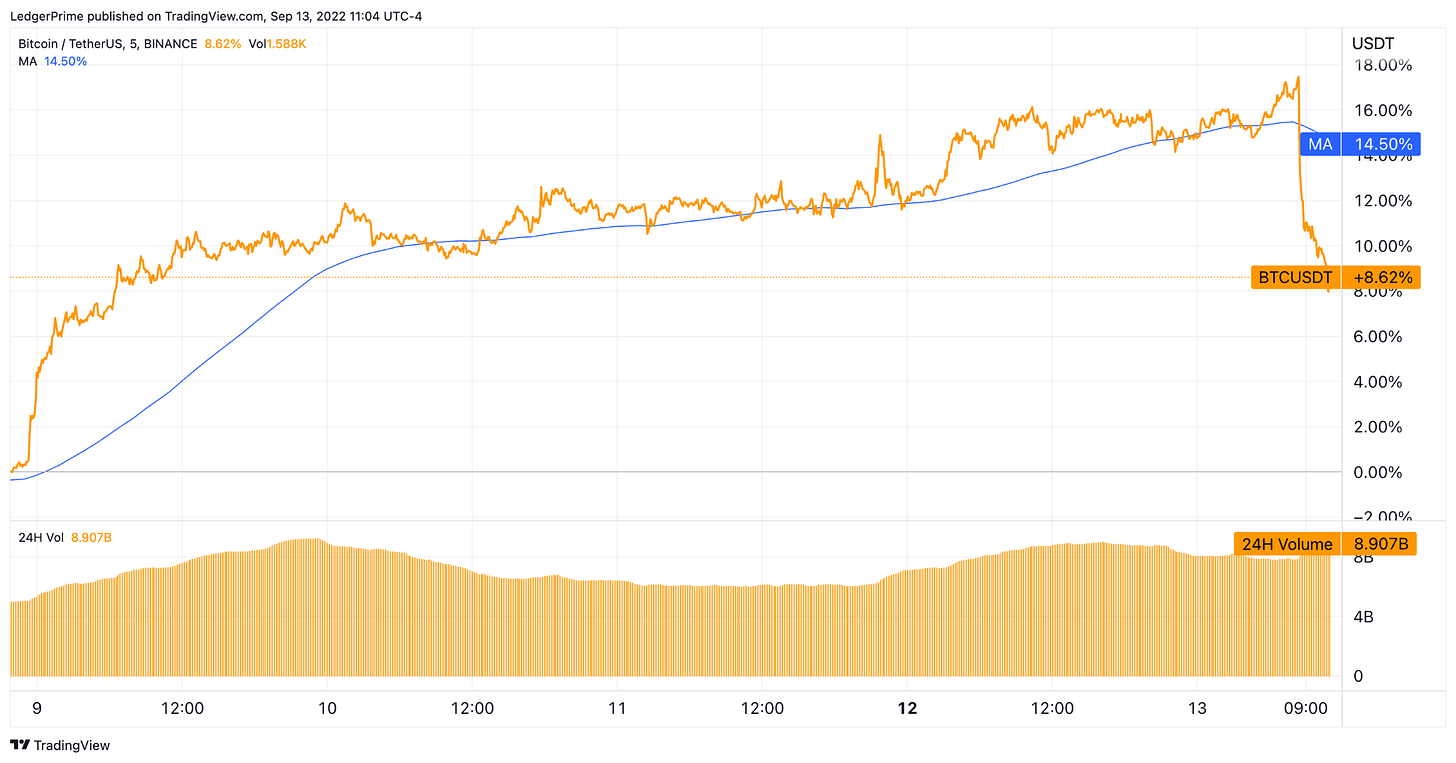

BTC (+8.62%)

Price:

Current price at $21.07K, selling resistance is found at $22.75K mark while major support appears at $20.75K. Over the week, price ranged from a high of $22.423 to a low of $18,650.

Metrics:

BTC spot volume is currently at $8.907B.

Current Market Cap of BTC is at $370B, which represents a 38.227% of Total Crypto Market Cap.

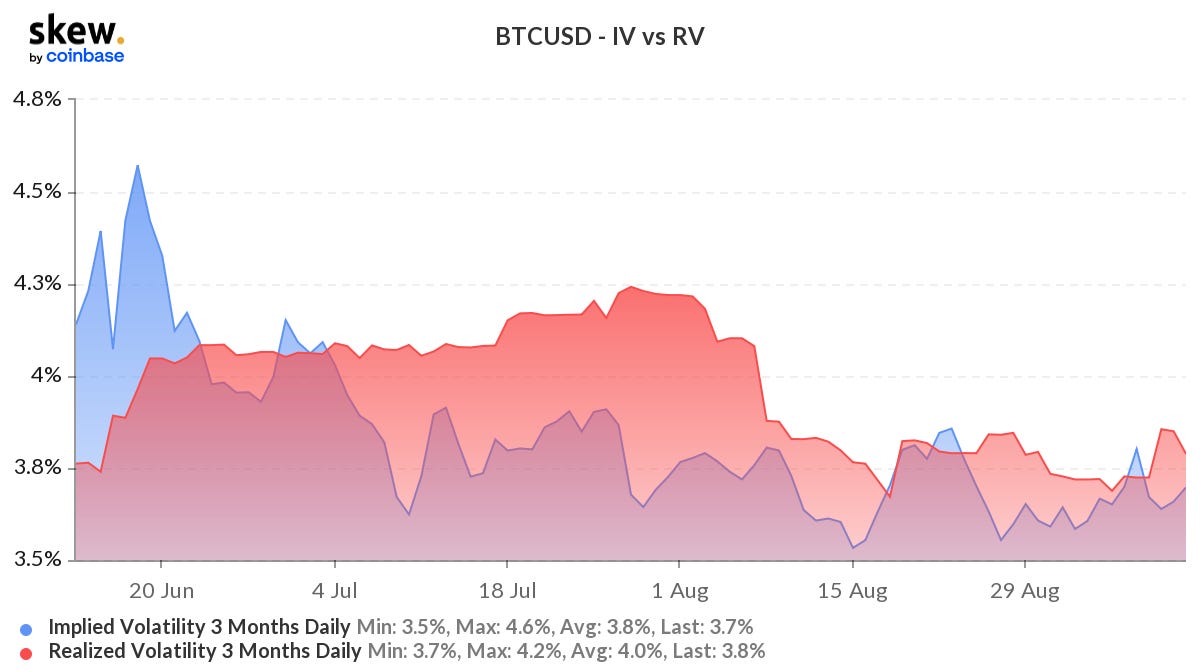

BTC volatility: The current, annualized volatility is at 0.66, 25.52% higher than last week.

From last week:

📈 Correlations:

7-Day Correlation: ETH (0.83)

30-Day Correlation: ETH (0.87)

📈 Betas:

7-Day Beta: ETH (0.86)

30-Day Beta: ETH (0.62)

News:

Stone Ridge board approved plan for 'liquidation and dissolution' of its Bitcoin fund – Link

Options:

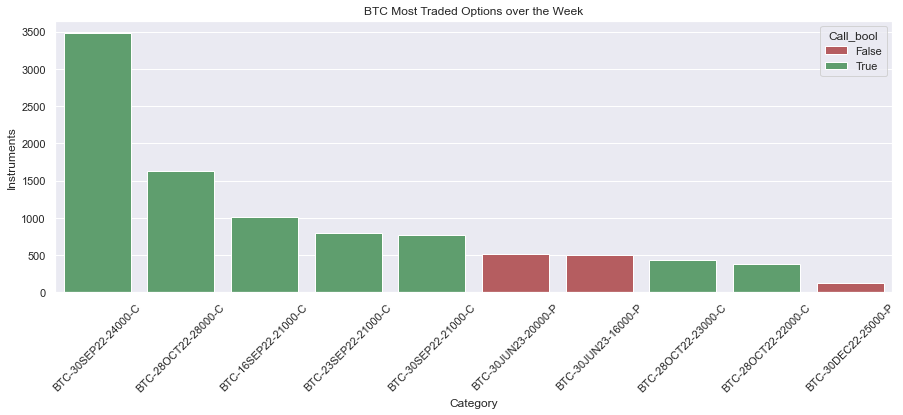

BTC continues to be dominated by the buy side after the weekend. Investors are interested in near OTM maturities such as the BTC-30SEP22-24000-C (3.5K) or the BTC-28OCT22-28000-C (1.6K).

Strategies:

Investors have shifted their momentum and seem now interested in more optimistic strategies. This week the Bull Diagonal Spread (Calls) (3.5K) was the most traded structure, followed by the Bull Put Spread.

IV profile:

1 Wk ATM 77.6% (avg: 64.5%)

1 Mth ATM 72.4% (avg: 68.0%)

25d Skew:

1 Wk -5% (avg: 10%)

1 Mth 5% (avg: 12%)

ETH (-2.94%)

Price:

Current price at $1.6K, current selling resistance is found at $1.75K while bullish support takes place at the $1.6K mark. Over the week the price ranged between a weekly high of $1,780 and a low of $1,502.

Metrics:

ETH spot volume is currently at $1.72B

Current Market Cap of ETH is at $216B, which represents 20.015% of Total Crypto Market Cap

ETH volatility: The current, annualized volatility is at 0.78, 6.04% lower than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.83)

30-Day Correlation: BTC (0.87)

📈 Betas:

7-Day Beta: BTC (0.57)

30-Day Beta: BTC (1.09)

News:

Norwegian central bank uses Ethereum to build national digital currency – Link

Options:

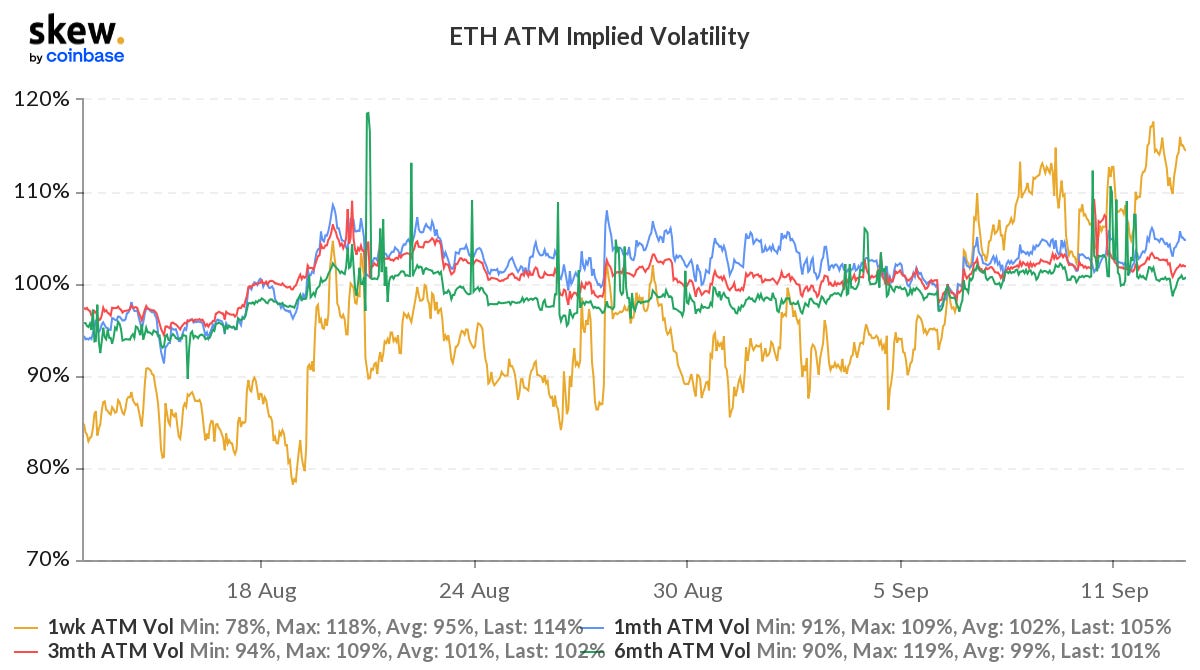

With the Merge event on every trader’s mind, this week’s option profile was dominated by year-end, close-to-money call trading, with options such as the ETH-30DEC22-2500-C (18.5K) and the ETH-30DEC22-2000-C (16K).

Strategies:

The Bull Put Spread and the Bear Call Spread were the most traded structures ahead of the Merge, at a volume of 18K each. This denotes the overall decrease in volume that we have seen since June.

IV profile:

1 Wk ATM 114% (avg: 95%)

1 Mth ATM 105% (avg: 105%)

25d Skew:

1 Wk 3% (avg: 7%)

1 Mth 8% (avg: 8%)

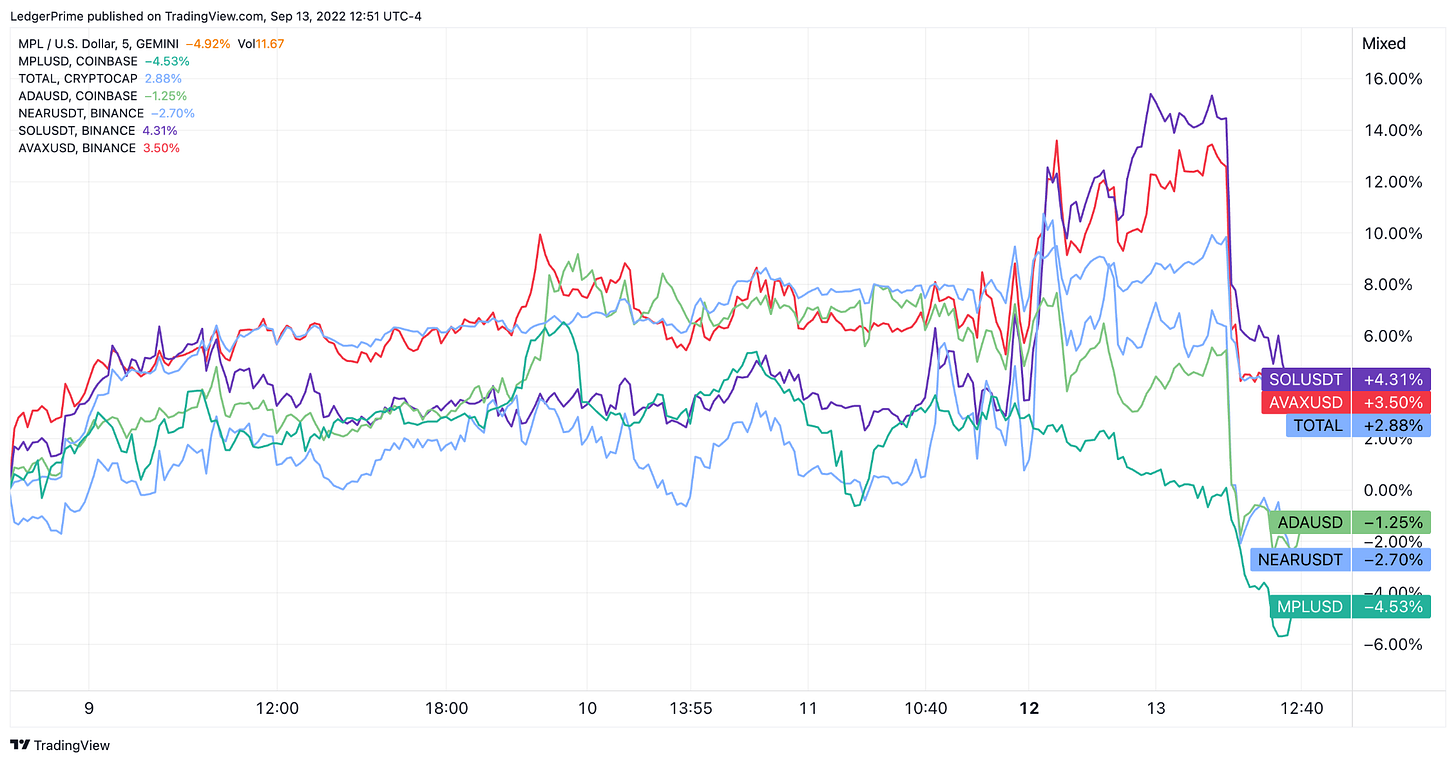

AVAX (+1.01%)

Price:

Current price at $19.71, selling resistance takes place above the $22 range while the closest price support seems to be at $19.50. Over the week the price ranged between a weekly high of $21.80 and a low of $18.03.

Metrics:

AVAX spot volume is currently at $12.61M

Current Market Cap of AVAX is at $5.61B, which represents a 0.558% of Total Crypto Market Cap

AVAX volatility: The current, annualized volatility is at 0.77, 0.99% lower than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.72), ETH (0.76)

30-Day Correlation: BTC (0.80), ETH (0.81)

📈 Betas:

7-Day Beta: BTC (0.87), ETH (0.77)

30-Day Beta: BTC (0.99), ETH (0.73)

News:

Apricot Phase 6: Native Asset Call Deprecation – Link

SOL (+2.52%)

Price:

Current price at $34.83, selling resistance seems to occur at $39.00 while price support seems to be found at $35.00. Over the week the price ranged between a weekly high of $38.02 and a low of $30.61.

Metrics:

SOL spot volume is currently at $215.70M

Current Market Cap of SOL is at $12.36B, which represents 1.142% of Total Crypto Market Cap

SOL volatility: The current, annualized volatility is at 0.74, 2.23% higher than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.72), ETH (0.73)

30-Day Correlation: BTC (0.83), ETH (0.83)

📈 Betas:

7-Day Beta: BTC (0.50), ETH (0.37)

30-Day Beta: BTC (0.98), ETH (0.74)

News:

DApp activity rises 3.7% in August for the first time since May: Finance Redefined– Link

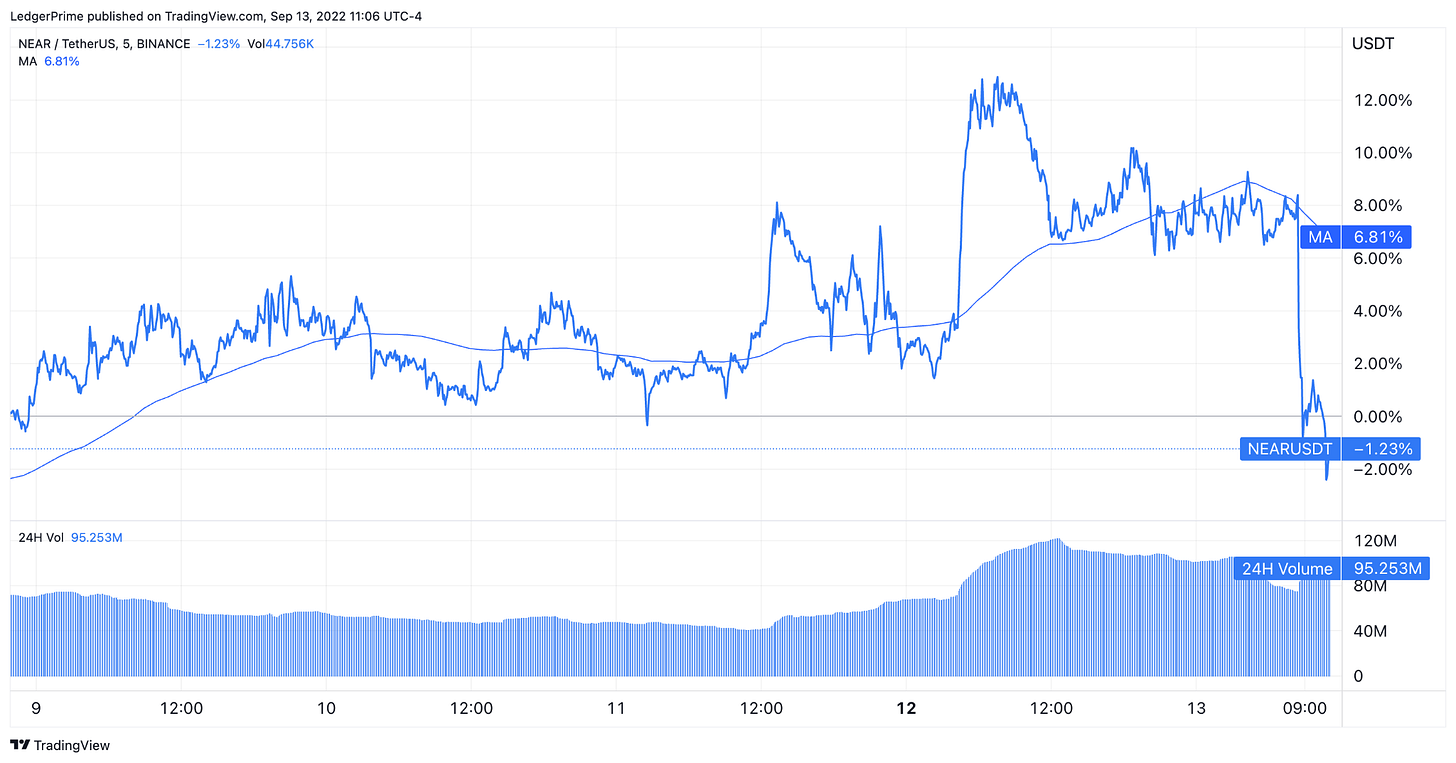

NEAR (-1.23%)

Price:

Current price at $4.56, selling resistance is found at $5.10 while price support seems to drive buying action at $4.50. Over the week the price ranged between a weekly high of $5.22 and a low of $4.04.

Metrics:

NEAR spot volume is currently at $95.25M

The current Market Cap of NEAR is at $3.41B, which represents 0.347% of the Total Crypto Market Cap

NEAR volatility: The current annualized volatility is at 0.90, 9.61% lower than last week.From last week:

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.58), ETH (0.59)

30-Day Correlation: BTC (0.71), ETH (0.73)

📈 Betas:

7-Day Beta: BTC (0.40), ETH (0.43)

30-Day Beta: BTC (0.98), ETH (0.81)

News:

NEARCON Highlights – Link

ADA (-3.13%)

Price:

Current price at $0.4717, with selling resistance at $0.51 while price support seems to be at the $0.47 level. Over the week the price ranged between a weekly high of $0.522 and a low of $0.456.

Metrics:

ADA spot volume is currently at $112.44M

Current Market Cap of ADA is at $17.21B, which represents a 1.648% of Total Crypto Market Cap

ADA volatility: The current, annualized volatility is at 0.78, 6.23% higher than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.68), ETH (0.76)

30-Day Correlation: BTC (0.71), ETH (0.71)

📈 Betas:

7-Day Beta: BTC (0.81), ETH (1.02)

30-Day Beta: BTC (1.00), ETH (0.76)

News:

Cardano (ADA) eyes 15% rally despite Charles Hoskinson's fear over 'macro factors' – Link

MPL (-4.92%)

Price:

Current price at $21.51, upwards selling resistance seems to be found at $23.00, while bullish action takes place at $21.50. Over the week the price ranged between a weekly high of $23.73 and a low of $18.58.

Metrics:

MPL spot volume is currently at $4.984K

Current Market Cap of MPL is at $144M, which represents a 0.013% of Total Crypto Market Cap

MPL volatility: The current, annualized volatility is at 0.85, 19.65% lower than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.14), ETH (0.17)

30-Day Correlation: BTC (0.21), ETH (0.21)

📈 Betas:

7-Day Beta: BTC (0.51), ETH (0.99)

30-Day Beta: BTC (0.64), ETH (0.57)

Upcoming events

For OTC inquiries, contact laura@ledgerprime.com

Telegram @lauravidiella or @medianbrain

For live Altcoin and Options data, join our Ledger Prime Analytics group chat here

The information provided here is not investment, tax, or financial advice and does not reflect LedgerPrime’s official stance on any position. You should consult with a licensed professional for advice concerning your specific situation.