Market Commentary - BOW 38

General Market Update

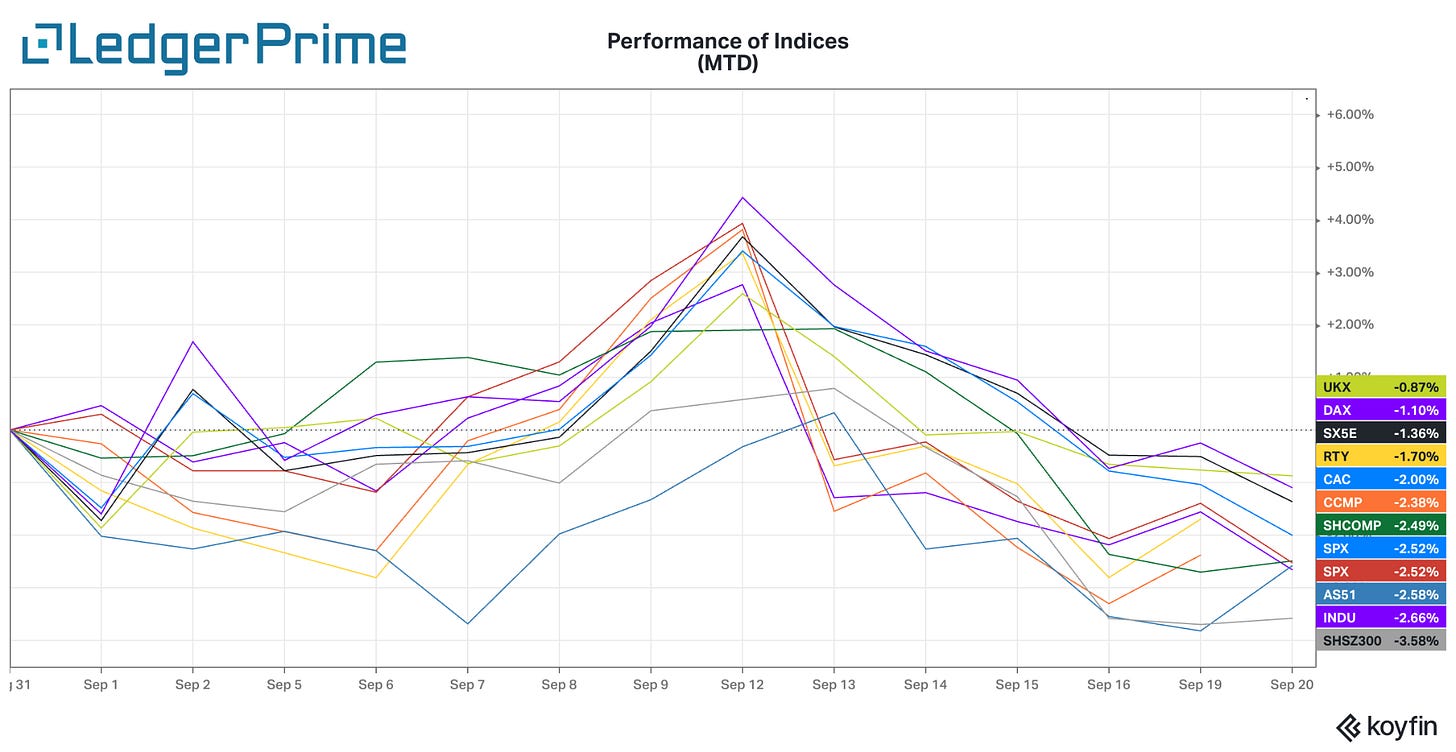

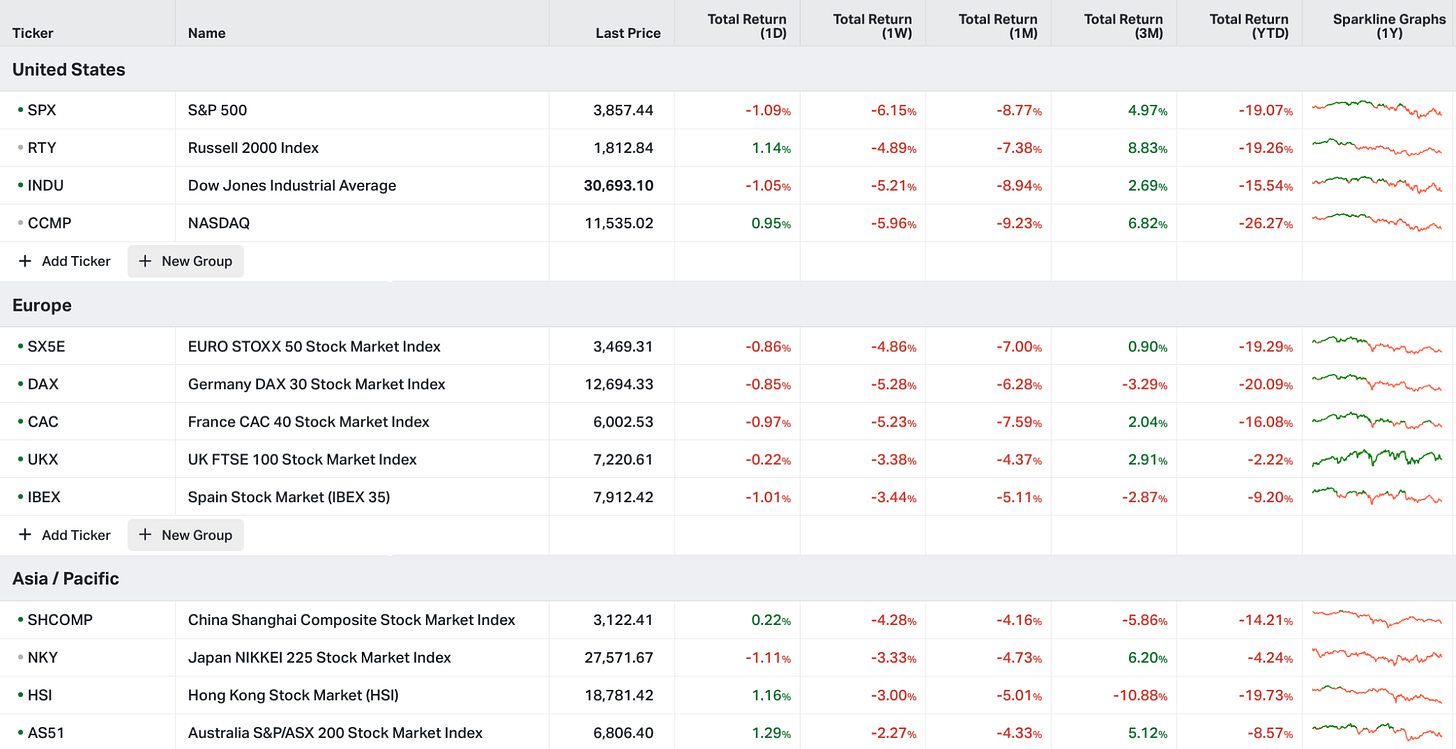

Stocks fell Tuesday ahead of the Federal Reserve’s next policy decision as investors grappled with the impact of rising rates on corporate earnings and valuations.

The central bank is expected to sharply raise interest rates again Wednesday in a bid to curb inflation, a move that will eventually slow the economy and likely ding company profits. At the same time, higher interest rates will constrain the prices that investors are willing to pay for a slice of those earnings.

Those hurdles could make it harder for major stock indexes to climb out of the gully in which they have found themselves nearly three-quarters of the way through 2022. The S&P 500 has fallen 19% this year, with rising interest rates eating into the lofty valuations that stocks enjoyed for much of the pandemic era.

Wall Street Journal, Sept. 20, 2022 5:05 pm ET

Crypto Market Update

Global Crypto Market Cap 📉 3.45% ($970 Bn)

Altcoin share of Market 📉 0.48% (60.55 %)

Crypto Fear and Greed Index: 23 (Extreme Fear)

Crypto News & Articles

Ethereum developer confirms Shanghai upgrade will not unlock staked tokens. The Ethereum website incorrectly states staking withdrawal functionality will be enabled in the Shanghai upgrade, leaving depositors in limbo. – Link

Ethereum vanity address exploit may be cause of Wintermute hack. It may take less than 2 months to brute force hack an Ethereum vanity address using a GPU mining rig. – Link

Experts argue SEC cannot claim jurisdiction over Ethereum transactions. – Link

BTC (-3.13%)

Price:

The current price at $19.09K, selling resistance is found at $19.5K, while some bull support appears at $18.50K. Over the week, the price ranged from a high of $21,316 to a low of $18,471.

Metrics:

BTC spot volume is currently at $6.254B.

The current Market Cap of BTC is at $410B, which represents 39.204% of the Total Crypto Market Cap.

BTC volatility: The current annualized volatility is at 0.64, 8.57% lower than last week.

From last week:

📈 Correlations:

7-Day Correlation: ETH (0.76)

30-Day Correlation: ETH (0.84)

📈 Betas:

7-Day Beta: ETH (0.27)

30-Day Beta: ETH (0.54)

News:

The market isn't surging anytime soon — so get used to dark times– Link

Options:

This week’s BTC option profile has been tilted mostly towards the sell side, although the most traded option was a call. Clear interest in near expiries, with BTC-28OCT22-24000-C and BTC28OCT22-18000-P being the most traded

Strategies:

This week’s most traded strategy was the Short Risk Reversal, at a volume of 2.3K, followed by the Bear Call and Put Spread.

IV profile:

1 Wk ATM 71.7% (avg: 65.9%)

1 Mth ATM 66.5% (avg: 68.1%)

25d Skew:

1 Wk 12% (avg: 11%)

1 Mth 12% (avg: 13%)

ETH (-7.95%)

Price:

The current price at $1,343 current selling resistance is found above $1.4K, while bullish support takes place below the $1.3K mark. Over the week, the price ranged between a weekly high of $1,638 and a low of $1,295.

Metrics:

ETH spot volume is currently at $965.52 M

The current Market Cap of ETH is at $168B, which represents 17.22% of the Total Crypto Market Cap

ETH volatility: The current annualized volatility is at 0.86, 6.63% higher than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.76)

30-Day Correlation: BTC (0.84)

📈 Betas:

7-Day Beta: BTC (2.65)

30-Day Beta: BTC (1.05)

News:

SEC Claims All of Ethereum Falls Under US Jurisdiction – Link

Options:

Ethereum’s option profile was a bit more optimistic, with calls such as the ETH-31MAR23-5000-C (59K) and the ETH-30SEP22-1600-C (28K) trading the most.

Strategies:

This week, the most traded strategies for Ethereum have been the Bull Call Spread (118K) and the Bear Call Spread (98 K).

IV profile:

1 Wk ATM 93% (avg: 98%)

1 Mth ATM 87% (avg: 101%)

25d Skew:

1 Wk 10% (avg: 8%)

1 Mth 12% (avg: 9%)

AVAX (-6.54%)

Price:

The current price at $16.77, and selling resistance takes place above the $18.5 range, while the closest price support seems to be at $16.50. Over the week, the price ranged between a weekly high of $19.92 and a low of $16.52.

Metrics:

AVAX spot volume is currently at $3.202M

The current Market Cap of AVAX is at $5.38B, which represents 0.521% of the Total Crypto Market Cap

AVAX volatility: The current annualized volatility is at 0.85, 7.06% higher than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.74), ETH (0.77)

30-Day Correlation: BTC (0.80), ETH (0.83)

📈 Betas:

7-Day Beta: BTC (2.25), ETH (0.71)

30-Day Beta: BTC (1.21), ETH (0.86)

News:

Apricot Phase 6: Native Asset Call Deprecation – Link

SOL (-2.75%)

Price:

The current price at $31.85, selling resistance seems to occur at $33.00, while price support seems to be found at $31.00. Over the week, the price ranged between a weekly high of $35.49 and a low of $30.77.

Metrics:

SOL spot volume is currently at $93.72M

The current Market Cap of SOL is at $11.55B, which represents 1.16% of the Total Crypto Market Cap

SOL volatility: The current annualized volatility is at 0.84, 5.75% higher than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.76), ETH (0.78)

30-Day Correlation: BTC (0.80), ETH (0.81)

📈 Betas:

7-Day Beta: BTC (2.06), ETH (0.69)

30-Day Beta: BTC (1.14), ETH (0.79)

News:

Metaplex Set to Airdrop MPLX Tokens to Solana NFT Creators– Link

NEAR (-4.93%)

Price:

The current price at $3.90, selling resistance is found above $4.05, while price support seems to drive buying action at $3.84. Over the week, the price ranged between a weekly high of $4.65 and a low of $3.84.

Metrics:

NEAR spot volume is currently at $2.87M

The current Market Cap of NEAR is at $3.29B, which represents 0.325% of the Total Crypto Market Cap

NEAR volatility: The current annualized volatility is at 0.94, 2.32% higher than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.72), ETH (0.77)

30-Day Correlation: BTC (0.68), ETH (0.70)

📈 Betas:

7-Day Beta: BTC (2.94), ETH (0.91)

30-Day Beta: BTC (1.21), ETH (0.93)

News:

NEAR Launches Web3 Regional Hub in India for Blockchain Talent Development and Innovation – Link

ADA (-5.55%)

Price:

The current price is at $0.44, selling resistance at $0.49, while price support seems to be at the $0.44 level. Over the week, the price ranged between a weekly high of $0.489 and a low of $0.436.

Metrics:

ADA spot volume is currently at $51.64M

The current Market Cap of ADA is at $15.47B, which represents a 1.613% of Total Crypto Market Cap

ADA volatility: The current annualized volatility is at 0.72, 7.01% lower than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.72), ETH (0.74)

30-Day Correlation: BTC (0.74), ETH (0.76)

📈 Betas:

7-Day Beta: BTC (1.99), ETH (0.59)

30-Day Beta: BTC (0.88), ETH (0.66)

News:

Cardano (ADA) Price Fails To Break $0.5 Despite Vasil Hype – Link

MPL (-8.34%)

Price:

Current price at $19.44, upwards selling resistance seems to be found at $22.00, while bullish action takes place at $19.50. Over the week the price ranged between a weekly high of $22.33 and a low of $19.50.

Metrics:

MPL spot volume is currently at $10.504K

Current Market Cap of MPL is at $125M, which represents a 0.014% of Total Crypto Market Cap

MPL volatility: The current, annualized volatility is at 0.78, 8.98% lower than last week.

From last week:

📈 Correlations:

7-Day Correlation: BTC (0.31), ETH (0.27)

30-Day Correlation: BTC (0.28), ETH (0.27)

📈 Betas:

7-Day Beta: BTC (1.12), ETH (0.29)

30-Day Beta: BTC (0.68), ETH (0.50)

Upcoming events

For OTC inquiries, contact laura@ledgerprime.com

Telegram @lauravidiella or @medianbrain

For live Altcoin and Options data, join our Ledger Prime Analytics group chat here

The information provided here is not investment, tax, or financial advice and does not reflect LedgerPrime’s official stance on any position. You should consult with a licensed professional for advice concerning your specific situation.