Quantitative Financial Risk Management For Crypto Projects and Investors

Motivation

Imagine you’re a cryptocurrency entrepreneur working on the next big DeFi startup. It’s a raging bull market and you’re sitting on $100M worth of tokens on your treasury balance sheet. Although you’re thrilled with the war chest of capital, the recent volatility in crypto markets has gotten you nervous about the future value of your treasury. As a growing startup, you’re required to pay software developers, lawyers, accountants, and also allocate funds for future investment, however, you’re not certain as to whether the $100M will be worth $200M or $20M one year from now.

While many investors in the crypto space have a long-term view, the wild mark-to-market swings can be a punch to the gut for even the most battle-hardened investors. This issue is even more serious for crypto projects and firms whose treasuries have significant exposures to their native token. This excellent piece by Messari highlights the crisis among DeFi treasuries and explains why many projects may face significant financial difficulties during the next bear market. Although it’s alluring to see a project’s treasury grow by 10x in just a few months, these volatile swings in price can be very distracting towards actually building the tech. While individual investors or hedge-funds may have the goal of maximizing total or risk-adjusted returns, crypto projects have more important things to focus on rather than speculating on the price of their token. The goal for them is to first be in a position to survive crypto winters which will then allow them to thrive in the subsequent years to come.

The purpose of this research piece is to analyze how both crypto projects and investors can use different hedging techniques to protect their portfolios from adverse downside moves. We’ll primarily focus on options hedging strategies but also briefly highlight the importance of diversifying into stablecoins.

Part 1: Hedging Downside Risk With Options

One of the primary benefits of hedging downside risk with options is they allow the investor to participate in the future upside price action while keeping losses fixed. If an investor decided to hedge with a futures contract instead of an option, then they would be reducing their exposure to the underlying asset. While this reduces their downside risk it also reduces their exposure to upside price moves as well. Investors who wish to maintain their existing position and are willing to pay a premium are likely better off using options as they can keep their upside exposure while capping adverse downward movements.

Let’s review a few approaches to hedge downside risk starting with simple techniques and then progressively add more detail in subsequent strategies. In all cases, we’ll assume that options are bought and sold at mid-price.

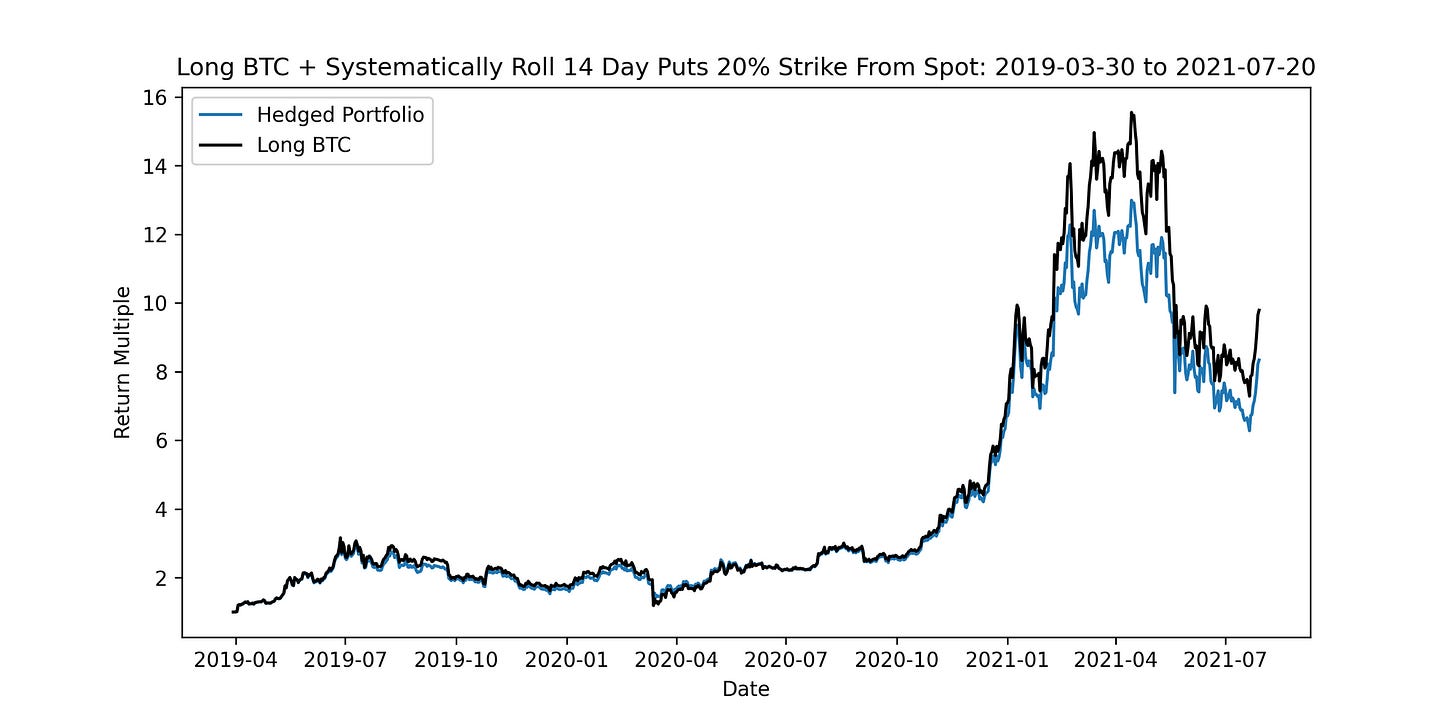

1. Systematically Rolling Put Options

Suppose an investor wants to be protected from a 20% crash relative to BTC’s current price. In this case, the strategy will simply involve the investor being long 1 BTC while continuously buying 1x BTC put option. Every time the put option expires, the investor will purchase the next available put option based on the current market conditions. Here’s how the logic works:

At t=0, look for option maturities closest to a specified maturity date (in this case we’ll experiment with 14, 30, and 60 days)

Once we’ve selected a given term, we find the put option with a strike closest to: Current BTC Price x (1 - 0.20)

Track the PNL of this selected option and hold it until maturity. When the option expires we will run through the first two steps and repeat the process

After running a few combinations we can see the overall results of this backtest across different maturities. While the Sharpe and Sortino (see Appendix for more details on these statistics) are noticeably better than owning BTC outright, the maximum drawdowns are not substantially better. In the “best” case, this hedging strategy encountered a 52% max drawdown which is not that much better than the 62% max drawdown from simply holding spot BTC.

There are a few reasons why this strategy is insufficient. Firstly, it assumes investors will hold the put option right up to maturity. Suppose BTC were to crash past the put strike but then recover and remain above the strike for the rest of the option’s life. In this case, the option would expire worthless and result in 100% of the premium to be lost. The only way for this strategy to make money in the long-run is for BTC to stay well below the put strike upon the maturity of the option because at least then the option will be in the money.

While we were able to reduce the max drawdown and improve our risk-adjusted returns relative to holding BTC, let’s explore further to see if we can refine this process with some smarter logic.

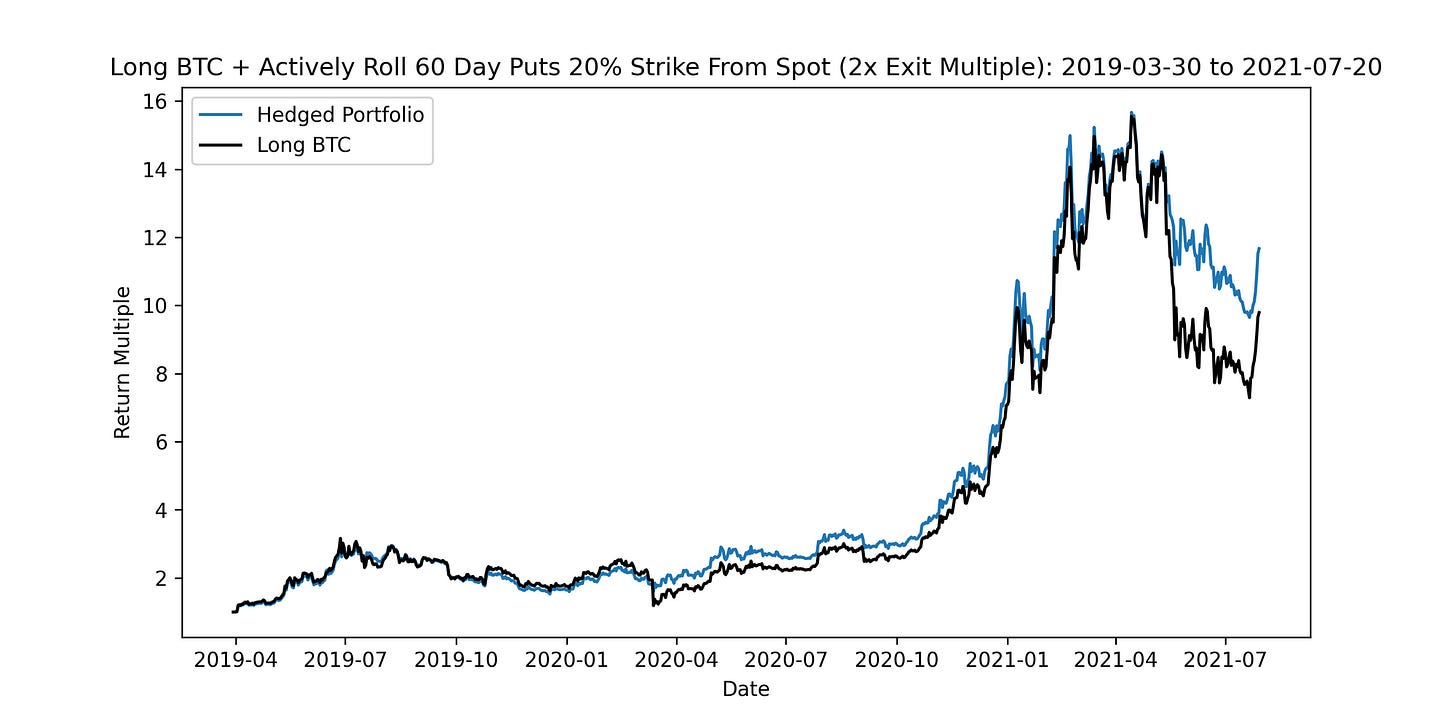

2. Rolling Puts With Smarter Exit Criteria

In Vineer Bhansali’s book, “Tail Risk Hedging”, he often indicated that a tail-risk strategy for protecting against downward price moves must be actively managed rather than using a naive systematic approach as described above. However, we can use this simple model as a foundation and enhance it with some of Bhansali’s suggestions.

When markets experience abnormal crashes, puts skyrocket in value as everyone in the market rushes to purchase these options. In the diagram below, the price of the put option jumped in value as BTC crashed from $60k to nearly $35k within the course of several days. The spike in the price of the put was short-lived and crashed just as fast. If a trader was long this put before the crash, there was only a small window of opportunity for the trader to monetize this put and roll into another option. Even though prices tumbled in a choppy decline for the weeks to follow, the put option decayed in value due to the high theta bleed. Note: an investor would lose the entire value of their put option if they held it until maturity because the option would expire worthless (spot was above strike at maturity).

To address this issue, Bhansali suggests including a “monetization multiple” which is used to determine when to exit the put option. For example, suppose the monetization multiple is 2.0x. In this case, if we buy a put option for $100, then if the price of the option crosses $200 ($100 x 2.00), the investor would sell this option and roll into a new put. This way the investor can recycle their profits from the put and compound their returns faster. We’ll use the exact same logic as outlined in the first approach but with one additional criteria:

If the current price of the put is 2x greater than the original cost of the put, then exit the position and roll into the next option

Recall, the goal is to capitalize on large spikes in the put option price and exit at a profit rather than waiting until the option reaches maturity. We can see some benefits from this approach as it offers lower maximum drawdowns and higher risk-adjusted returns relative to the original approach. Even then, a 50% drawdown is not ideal for an actively managed strategy.

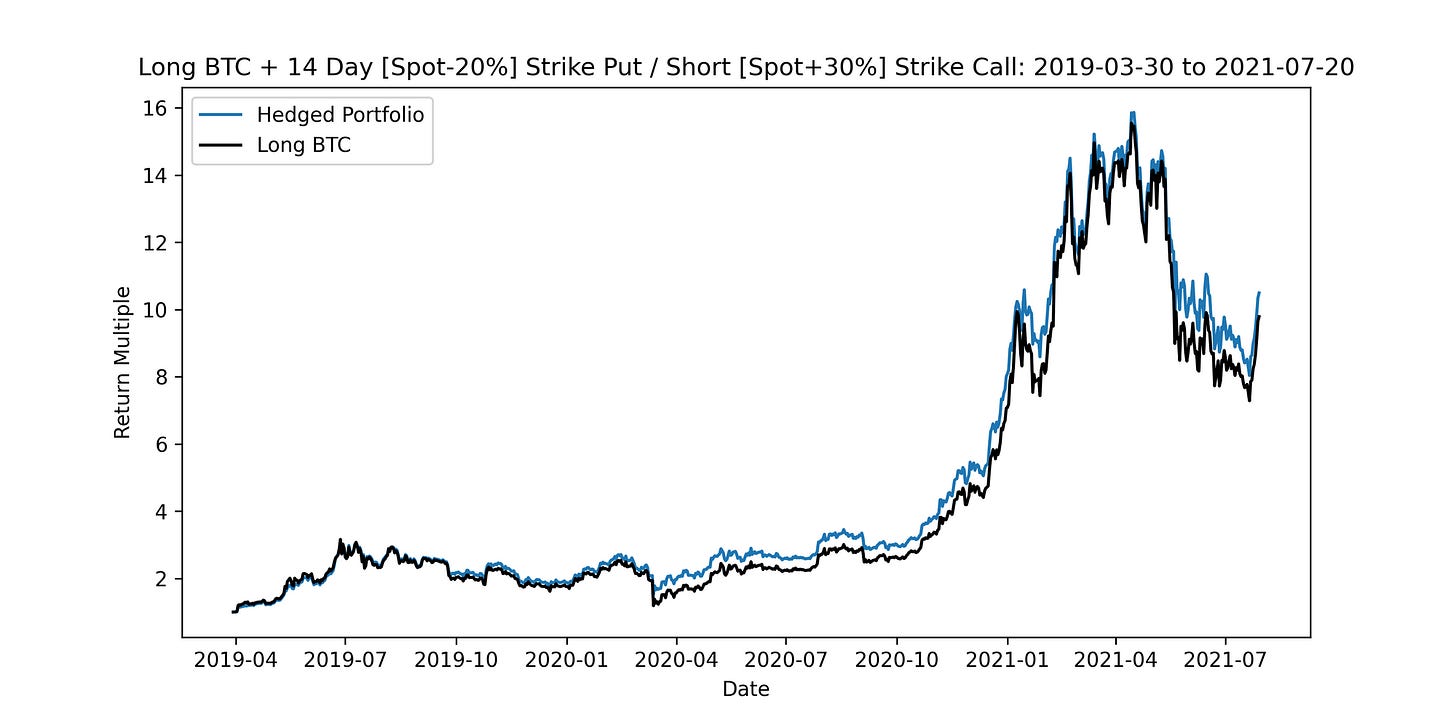

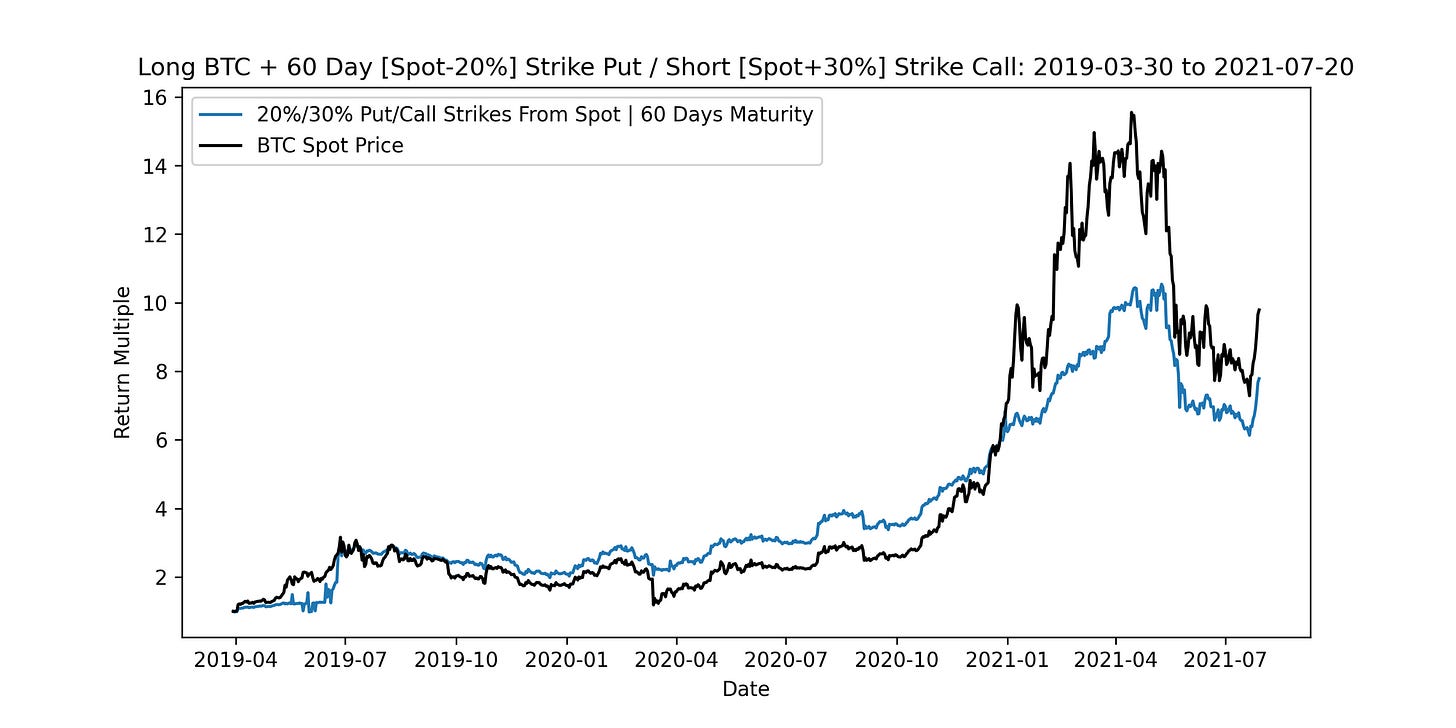

3. Rolling Puts and Selling Calls

As seen above, constantly setting aside funds to buy downside price protection can cause a drag on overall returns. One potential solution inspired by UMA’s range tokens would be to finance the purchase of puts by selling OTM call options. In options trading, the combination of selling a call and buying a put is referred to as a risk reversal. When we combine a risk reversal with the underlying asset, the position is referred to as a collar. The benefit of a collar is that it allows for capped downside losses which is paid for by capped upside price action.

Let’s review the logic of this strategy:

At t=0, look for option maturities closest to a specified maturity date (in this case we’ll experiment with 14, 30, and 60 days)

Once we have selected a given term:

Find the put option closest to: Current BTC Price x (1 - 0.20)

Find the call option closest to: Current BTC Price x (1 + 0.30)

Note: In this case, the collar strikes are not equally spaced. The reason for this is because crypto generally has an upward bias, therefore, it probably makes more sense to widen our call strike to avoid getting called on this option.

Once we’ve selected which options to trade, we calculate the PNL of buying the put and selling the call and track this over time. To keep the model simple and avoid over-optimization, we’re not including the monetization multiple (this will help isolate the impact of selling the calls). Overall, this strategy performed decently well. Sharpe, Sortino, and maximum drawdown statistics were all much better than simply holding spot BTC. Surprisingly, we were able to narrow the maximum drawdown to only 40%. Although these results are far from perfect, this indicates that a hedging solution similar to a collar or Range Token may offer some benefit. As a potential next step with this particular strategy, we could look into modelling a costless collar position where the puts and calls are dynamically selected so the net cost at inception is zero.

Summary On Options Backtests

Despite the different approaches, none of these option strategies really stood out as obvious winners. Although we were able to get better risk-reward metrics relative to holding spot BTC, these results are inadequate for institutional investors to begin allocating to any of these strategies. However, this research can serve as a starting point to build new and more advanced strategies which can be tailored to individual investor needs. Every investor will have different time-horizons and risk tolerances, therefore, creating a customized solution is likely the most practical way to effectively implement a hedging program.

Part 2: Diversifying Into Stablecoins

While it is not ideal for projects to sell all of their token treasury into stablecoins, finding a healthy balance is crucial for limiting massive drawdowns and ensuring long-term financial stability. While some projects have chosen to diversify some of their treasuries into other cryptocurrencies this approach will likely not provide the necessary cushioning during a massive crash. During tail-risk events, correlations of all cryptos almost always approach +1 which means the benefits of diversifying into other cryptos is usually not effective. In other words, one cannot rely on historical statistical relationships such as betas or correlations to remain constant when BTC is crashing down 20% in a single day.

In my opinion, the only feasible solution currently available for crypto treasuries to reduce their risk would be to sell a portion of their token holdings into stablecoins. Although it is not as exciting as trading options, from preliminary analysis, selling the underlying asset for stablecoins offers a good risk-reward. Below are some plots to showcase the various maximum drawdowns associated with how much cash is in the overall portfolio. This model simply iterates through different cash and crypto portfolio weightings which are rebalanced on a month-end basis. It’s important to note that we’re beginning our analysis with data from 2020 onwards.

For example, ever since UNI started trading, if the project had maintained a 60% allocation to stablecoins, then their maximum drawdown would have been around 35%. However, given they held (and continue to hold) 100% of their treasury in UNI tokens, their portfolio has experienced a maximum drawdown of nearly 70% since inception! These maximum drawdown values are based on historical data and are not forward-looking.

Similarly, let’s look at the Sortino ratios for the various assets. We can see a 60-90% cash allocation is usually the sweet spot for the maximum Sortino ratios. In other words, the better risk-adjusted trade is to allocate only a few percentage points of the portfolio to any given crypto (with the exception of ETH). However, this may not be in the best interest of what the community wants. Perhaps the community seeks to gain the largest absolute return regardless of volatility which in that case they should allocate much more to the token. Nevertheless, this quantitative analysis can serve as a guiding point for treasuries and investors to think about their portfolio risk.

Conclusion

In its current form, a systematic options strategy is not feasible in the cryptocurrency market. We could backtest different combinations of optimal maturities and strikes, however, at that point, we would likely overfit the results which would show excellent historical performance but likely not fare well in real-world markets. Furthermore, it’s important to keep these points in mind:

Trading options can be highly path-dependent and lead to very different results depending on when the backtest begins. A potential solution would be to slowly fade into a position by purchasing increments on a daily basis. This in effect should reduce the variance of the strategy and help reduce overfitting but requires further analysis.

There’s a risk of backtest overfitting when we tweak various parameters. For example, in the second backtest, fine-tuning the monetary multiple across 100 different values between 1 to 3 will likely overfit the results. This same issue is present as we add more complexity into our models.

Even if this strategy were to perform well in practice it’s unlikely the current cryptocurrency option market would be able to absorb the large capital inflows into the puts required for hedging without significant slippage.

Systematic cryptocurrency option hedging strategies will work best when we have more data to study several market cycles and as option market liquidity improves. Although we are still a few years away from this, it’s helpful to start thinking about these ideas now and build a base.

It should be noted that options in themselves can be especially useful for certain parties. Many miners and lenders use options to hedge their risks because they have fixed liabilities with a known time horizon. Furthermore, investors may want to protect a portion of their portfolio from losses over a fixed period of time.

Take for example, a crypto miner who wants to make a large capital expenditure investment of mining rigs in 6 months with BTC but doesn’t want to sell the BTC yet (because they want exposure to future price appreciation). In this case, they could purchase a 6 month OTM put option on BTC to ensure their losses would be capped right up until they wish to make the mining investment. In addition to buying the put, the miner could also sell a 12 month OTM call option on BTC which could finance the purchase of the put (this is commonly referred to as a horizontal or time-spread). After 6 months once the miner begins to generate BTC from its capital investment, even if BTC were to rally past the call strike, the miner would still be in a good position as they would be generating BTC on a continuous basis.

In this case, the miner would not necessarily benefit from systematic option strategies, rather they would trade options on an ad-hoc basis to align with fundamental business needs. The systematic strategies will likely be more relevant for cryptocurrency hedge-funds as many of them have high beta exposures to the market.

Lastly, as discussed above it makes sense for most cryptocurrency projects to divest a portion of their treasury into stablecoins to prepare for future volatility. In my opinion, this is currently the most feasible way for projects to continue financing operations which can allow them to attract world-class developers, engage with communities, and help advance the ecosystem forward.

As the decorated US Army General George Patton famously said, “A good plan violently executed now is better than a perfect plan executed next week.” Although we are all still enjoying this bull-market it is worthwhile to take a minute and think about how many ground-breaking crypto projects the world didn’t get to see all because these projects mismanaged their finances in the previous bear market. Let’s be wise to learn and plan accordingly.

If you're a miner, DeFi project, or investor interested in learning more about hedging solutions feel free to reach out: samneet@ledgerprime.com.

Acknowledgements: Vishal Kankani for discussing the limitations of running a systematic strategy in current crypto option markets. Kevin Chan for explaining how UMA Range Tokens work and inspiration for modelling the collar backtest. Markos Petrocheilos for clarifying the approach towards modelling the backtest and suggesting future improvements for avoiding overfit. Kevin Pang for walking me through how to think about PNL calculations. And lastly, Nikhil Talwar for proof-reading and providing valuable insights pertaining to costless collars and hedging mining risk.

Disclaimer: Nothing mentioned in this article constitutes as financial advice. Opinions expressed are solely my own and do not express the views or opinions of LedgerPrime.

Appendix:

All of these statistics below were calculated using the quantstats Python library.

Sharpe Ratio: this is a commonly used metric to quantify the risk-reward of an investment strategy. A simplified version of the Sharpe ratio can be thought of as the average return of the strategy divided by the standard deviation of the strategy return.

Sortino Ratio: this is very similar to the Sharpe ratio, except in this case we’re only looking at downside volatility. Investors are usually not disappointed when they see upside price volatility so we can adjust the calculations to be average return of the strategy divided by downside deviation of the strategy returns.

Maximum Drawdown: this is simply calculated as the peak to valley percentage moves over the entire period of the backtest. Strategies with large maximum drawdowns aren’t ideal as this means investors are left underwater.